What is WACC?

What is WACC?

In this blog, we discuss the components of Weighted Average Cost of Capital “WACC” and how it factors into Valuation conclusions.

As noted in our blog posted on August 10, 2021, Valuation Approaches: The Income Approach, Chartered Business Valuators (“CBVs”) do not have the ability to see into the future. Instead of a crystal ball, CBVs use discount rates to account for the underlying risk associated with future cash flows and earnings.

But how are discount rates determined?

CBVs commonly use the Weighted Average Cost of Capital, or “WACC” as the discount rate in their valuations. In this blog, we discuss the components of WACC and how the WACC factors into valuation conclusions.

Weighted Average Cost of Capital

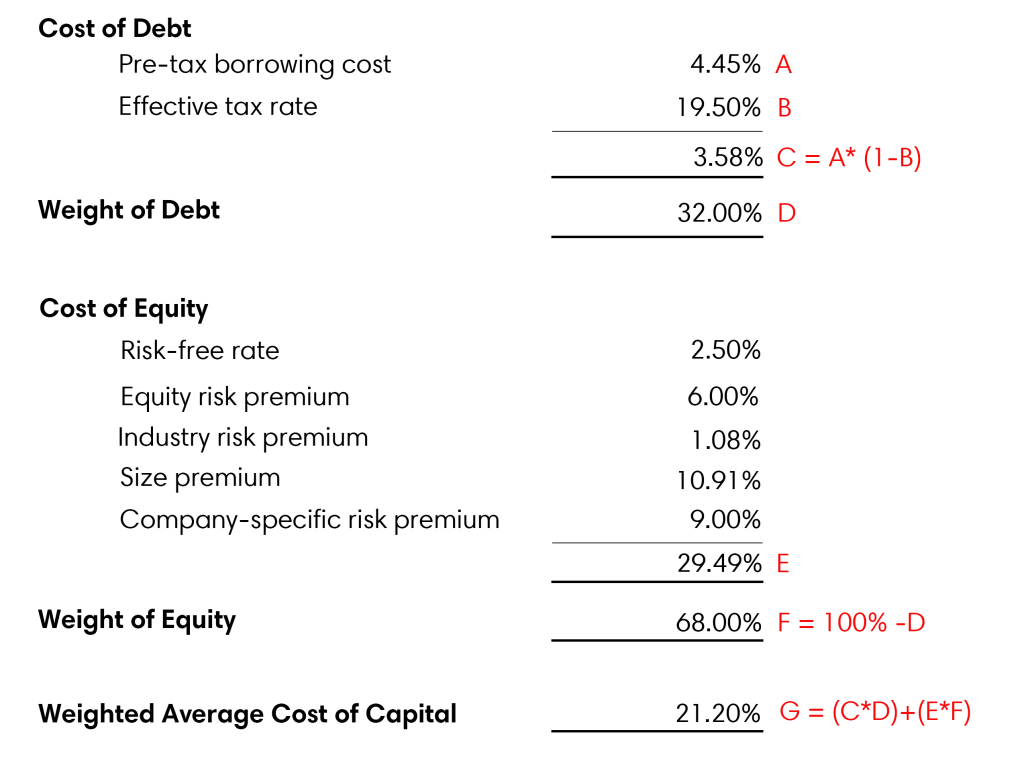

WACC is calculated as the weighted average of the cost of the debt and equity financing a company has used to finance operations:

WACC = (Cost of Debt x Weight of Debt) + (Cost of Equity x Weight of Equity)

Cost of Debt

A company’s cost of debt is essentially the interest rate a company pays, or can expect to pay, on its debt. To capture the advantage of interest being tax deductible, cost of debt is calculated on an after-tax basis as follows:

Cost of Debt = Pre-Tax Borrowing Cost * (1 – Effective Tax Rate)

Cost of Equity

Cost of equity is the rate of return required by a notional investor on the equity of a company. It can be calculated using two methods: the build-up method and the capital asset pricing model (“CAPM”). This blog focuses on the build-up method, which involves taking the sum of the following risk-related components:

- Risk-free rate – The expected return on a security that is regarded as free of the risk of default. In other words, the return a notional investor would forego by purchasing shares in the company being valued. The risk-free rate can be estimated using a government bond.

- Equity risk premium – The additional return expected by investors on a diversified portfolio, compared to the return they would expect from risk-free investments.

- Industry risk premium – The return on an equity portfolio in a certain industry may be more or less than the overall market. The industry risk premium reflects the additional risk or lower risk of a particular industry as compared to the market.

- Size premium – The risk associated with the size of a company based on the empirical observation that smaller companies are associated with greater risk.

- Company-specific risk premium – A chosen risk premium (or discount) to address company-specific or forecast factors that are not reflected in the equity, industry, or size risk premiums.

While most of the components are determined through complex mathematical equations and research, the company-specific risk premium relies on information related to the company being valued. Success indicators such as historical operations, product life-cycle stage, customer relationships, and brand name recognition, as well as forecast risk, can have an impact on the company-specific premium.

Weight of Debt and Equity

The weighting of debt and equity in the WACC calculation is determined using an appropriate capital structure for the company (i.e., 25%, 75%). The appropriate capital structure for each company may differ and may consider the following a company’s debt capacity, market levels of debt, and the “optimal capital structure”. The theory of the optimal capital structure of a company is dependent on a variety of factors beyond the scope of this blog.

Putting it all Together

Let’s look at an example of how WACC is calculated:

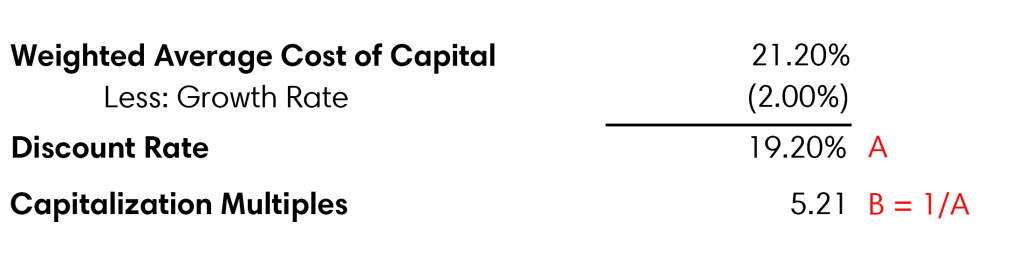

At this point you might be saying to yourself, ‘great, but how does this impact valuations?’ Well, the inverse of a company’s WACC, minus the anticipated long term growth rate, is equal to the multiple at which a company is capitalized. To continue the example above:

As you can see, the theory and calculations behind WACC and its components can be complex and difficult to determine. In order to accurately estimate a company’s WACC, a high level of professional judgement is required on behalf of the CBV.

Whether you are looking to value your business for purposes of sale, estate planning, litigation or anywhere in between, give the professionals at Davis Martindale a call. We have experience in all forms of valuation engagements.

Co-Authors

Louise Poole

CPA, CA, CBV, CFF

Partner

Valuation & Litigation

Mike Bushell

Associate

Valuation & Litigation

Work With Us

Our Valuation Advisors are ready to have

a personalized discussion with you.