What is a Valuation Report?

What is a Valuation Report?

This blog will focus on the most common type of report: Business Valuations. Similar to assurance services, Business Valuation Reports are offered at three different levels: Calculation, Estimate and Comprehensive.

Over the past 40 years, the business valuation profession has grown in Canada, and Chartered Business Valuators (“CBVs”) are becoming increasingly relied upon for offering a broad range of services to many different stakeholders. The ultimate objective is to provide relevant, useful and complete information so that end users of reports can understand the basis of the conclusions.

One of the most important decisions when engaging a CBV is determining the type of report that is most suitable for your needs. While CBV’s offer a wide range of reports – including Income for Support Reports, Limited Critiques and Contingent Tax Letters, among others – this blog will focus on the most common type of report: Business Valuations. Similar to assurance services, Business Valuation Reports are offered at three different levels: Calculation, Estimate and Comprehensive.

Calculation Report

A Calculation Valuation Report contains a conclusion as to the value of the shares, assets or interest in a business based on minimal review and analysis, and little or no corroboration of information.

A Calculation Valuation is typically performed by us for:

a) Small to mid-size companies for tax or succession planning purposes; and

b) Family law purposes when both spouses are familiar with the business and there is an expected resolution without mediation, arbitration or court.

Estimate Report

An Estimate Valuation Report contains a conclusion as to the value of shares, assets or an interest in a business based on limited review, analysis and corroboration of relevant information and is set out in a more detailed Valuation Report, as compared to a Calculation Valuation Report.

An Estimate Valuation is typically performed by us for:

a) Mid-size to large companies for tax or succession planning purposes;

b) Litigation – mid-size share, business or asset values;

c) Litigation – damage quantification;

d) Estate Litigation;

e) Sale/purchase of a minority shareholder to a majority shareholder; and

f) Family law purposes when the company is mid-size and the expectation the client will be going to mediation/arbitration or court proceedings to resolve the matter.

Comprehensive Report

A Comprehensive Valuation Report contains a conclusion as to the value of shares, assets or an interest in a business that is based on a comprehensive review and analysis of the business, its industry and all other relevant factors, adequately corroborated and generally set out in a detailed Valuation Report.

A comprehensive valuation is typically performed by us for:

a) Litigation – midsized to large share, business or asset values;

b) Litigation – damage quantification;

c) Estate Litigation;

d) Sale/purchase of a minority shareholder to a majority shareholder; and

e) Family law purposes when the company is large and the expectation the client will be going to arbitration or court proceedings to resolve the matter.

Which Type of Report is Best for You?

As noted above, the selection of a type of Valuation Report will depend on the level of assurance required by the user of the report – or in other words, their risk tolerance.

For example, a Valuation Report prepared for an income tax transaction may only require a low level of assurance (i.e. Calculation Valuation Report). This is because the restructuring may include a Price Adjustment Clause reducing the amount of tax risk a taxpayer is subjected to if the valuation conclusion is deemed by the CRA to be incorrect (read more about this in our blog Section 85 and Income Tax Planning).

If it is likely that a Valuation Report may be entered as expert evidence into Court (i.e. in a shareholder dispute or family law matter), the assurance required may be higher. This is because the CBV’s work may be critiqued by another valuator, and may be subject to cross-examination in Court. In such circumstances, it may be advisable to obtain an Estimate or Comprehensive Valuation Report.

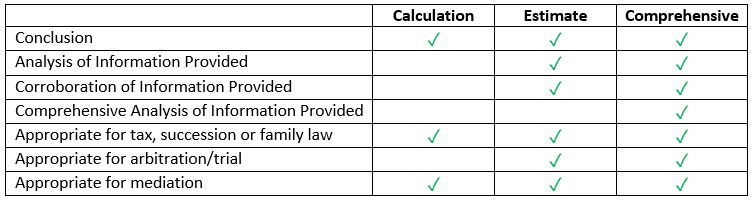

We set out the following table summarizing the similarities and differences between the three reports:

If you need help determining which level of report is best most suitable for your needs, give the experts at Davis Martindale a call today for a personalized discussion.

Co-Authors

Louise Poole

CPA, CA, CBV, CFF

Partner

Valuation & Litigation

Ron Martindale

BASc, CPA, CA, CBV, CFF

Partner

Valuation & Litigation

Work With Us

Our Valuation Advisors are ready to have

a personalized discussion with you.