Valuation Components: Introduction to the Building Blocks of Value

Valuation Components: Introduction to the Building Blocks of Value

In this first blog of a four-part series, we introduce the three main valuation components considered when your business is valued by a Chartered Business Valuator.

(Originally Posted May 14, 2019)

You have decided to engage a Chartered Business Valuator (“CBV”) to value your business. After signing the engagement letter, paying the retainer, providing financial disclosures and answering all their questions, the CBV presents you with a draft report of your businesses’ value. However, as you review the report you begin to ask yourself – what are the components of my business that are actually being valued?

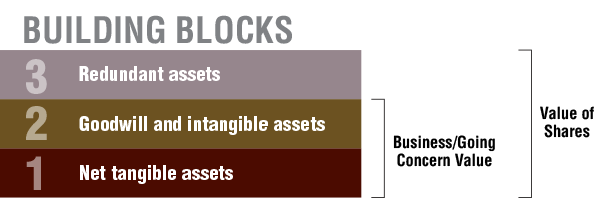

When looking at a valuation report, it is easy to focus on the overall valuation number or conclusion. However, this number is actually made up of a series of individual valuation components, or building blocks, which together, form the overall valuation conclusion. In this Davis Martindale blog series, we introduce the building blocks of value.

Building Blocks

It may be helpful to think of your business as a house – you have the foundation, the physical structure and furniture, and the extras, such as a hot tub. Each of these components individually has value, and it is important to consider them both independently, and interdependently, when determining the overall value of the house.

A business typically has the following components of value:

- Net tangible assets;

- Goodwill and identifiable intangible assets; and

- Redundant assets.

Net Tangible Assets

Net tangible assets are the foundation of the house. They consist of assets and liabilities required for your business to generate income or cash flow from active operations. In the same way that a foundation is essential to your home, these assets are core to your business – you simply could not continue operations without them.

Generally speaking, the higher the net tangible assets, the lower the overall business risk and higher the value. Examples of net tangible assets may include: working capital, furniture and fixtures, manufacturing equipment, and current and long-term debt used to finance business operations.

Goodwill and Identifiable Intangible Assets

Goodwill and identifiable intangible assets are the physical structure of the house and the furniture within it. They represent the value of your business over and above the net tangible assets. A house is usually worth more than the foundation only, and your business may be worth more than the net tangible assets it consists of.

Identifiable intangible assets are assets that can be transferred separately from the business and have intrinsic value, such as customer lists, brands and copyrights. Goodwill, on the other hand, represents an intangible asset, which is more general in nature, and therefore more difficult to quantify, such as management strength and business relationships. As a practical matter, valuators generally consider goodwill and identifiable intangible assets together.

Redundant Assets

Redundant assets represent the nice to have items at your house, such as a hot tub. Sometimes referred to as non-operating assets, redundant assets are included within your corporate entity, but are generally not required for your business to generate earnings or cash flow from operations. In the same way that a purchaser of your home is often not interested in buying your hot tub or water fountain, a potential purchaser is unlikely to be interested in purchasing the redundant assets of your business. If they are interested, they will have to pay extra.

Examples of redundant assets may include short-term investments, property and real estate, and excess cash. Redundant assets must be valued independently of, and in addition to, the bundle of assets your business utilizes to generate income from operations.

Of course, every situation is unique, and it is important to consider your business’ and industry specific circumstances when determining how to value each of your business’ building blocks.

If you need help navigating the complicated areas of business valuation, the experts at Davis Martindale can help you. Give us a call today for a personalized discussion. Give us a call today for a personalized discussion.

Co-Authors

Louise Poole

CPA, CA, CBV, CFF

Partner

Valuation & Litigation

Korab Ferati

CPA, CMA

Associate

Valuation

Work With Us

Our Valuation Advisors are ready to have

a personalized discussion with you.