Valuation Approaches: The Income Approach

The Income Approach

In this blog, we discuss the basic concepts of determining the value of a business using an income approach, including the circumstances for which the income approach may be used and how it is calculated.

(Updated with current content from our original post on August 10, 2021)

This is the second blog included in Davis Martindale’s 3-part series: Standard Approaches in Valuing Your Business.

- Part 1: The Adjusted Book Value Approach

- Part 2: The Income Approach

- Part 3: The Market Approach

How is the value of a business determined? While this question may seem simple, the answer is quite complex. To carry out the task of determining value, Chartered Business Valuators (“CBV”) use different techniques as primary or secondary approaches to valuation. These approaches fall under three main categories: asset approach, income approach, and market approach.

In this blog, we will examine the income approach in detail, including when it may be used and how it is calculated.

When is the Income Approach used?

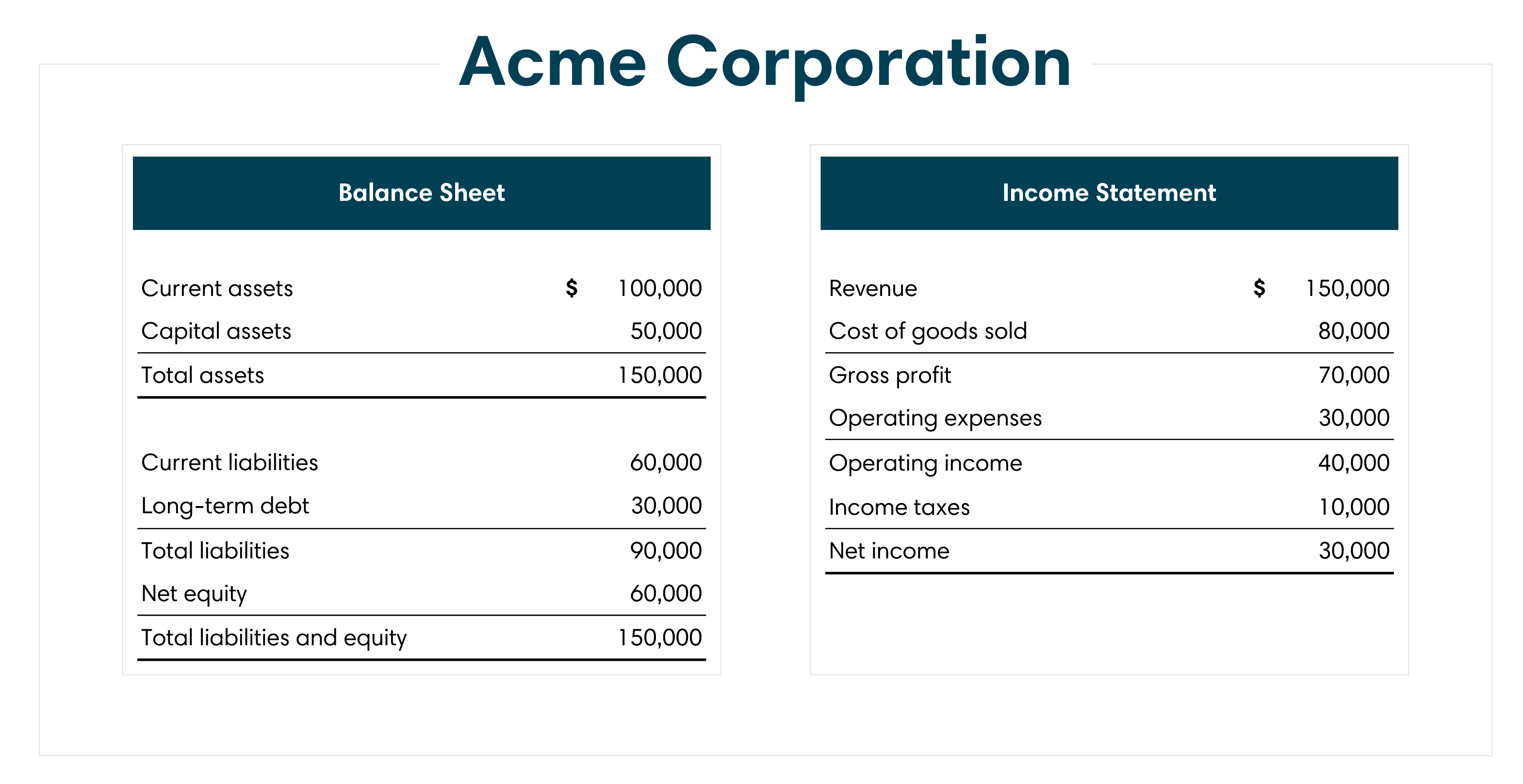

The income approach is used in cases where the future expected cash flow or earnings provide a sufficient return over the underlying asset value of a business. To illustrate, we consider the hypothetical balance sheet and income statement of:

Assuming the assets and liabilities are stated at fair market value, the value of Acme Corporation is, at a minimum, equal to the net equity value of $60,000 (Total assets $150,000 – Total liabilities $90,000), which is referred to as the Tangible Asset Backing (“TAB”).

We also consider the annual cash flows or earnings that the company has the ability to generate. Assuming Acme Corporation’s net income is equal to the annual maintainable earnings, the earnings provide a 50% return on the net asset value of the company ($30,000 / $60,000 = 50%). In this example, the annual earnings generated by the company may be sufficient to result in value. Therefore, an income approach should be considered.

The income approach considers the future profit expectations of a company and the underlying risks associated with the future profits. A hypothetical purchaser is willing to pay for a future cash flow and earnings stream; however, they also want to consider the risk and timing of the future cash flows and earnings.

Applying the Income Approach

Cash Flows and Earnings

The income approach values a business based on the assumption that the future profits generated by the business are the primary determinant of value in the business. This requires the CBV to consider future expected cash flows or earnings generated by the business.

The primary income approaches for valuations are:

- Discounted Cash Flow (“DCF”);

- Capitalized Cash Flow (“CCF”); and

- Capitalized Earnings.

Discounted Cash Flow Method

The Discounted Cash Flow method involves forecasting future cash flows and discounting the cash flows to their present value using an appropriate rate of return, as discussed below. The discounted cash flow method is appropriate for:

- A business with available and reliable forecasts;

- A business with a finite life; and/or

- Where the business is expected to experience variability for a number of years before achieving a sustainable operating level.

The Capitalized Cash Flow and Capitalized Earnings Methods

The Capitalized Cash Flow and Capitalized Earnings approaches use historical performance as a proxy for the company’s future cash flows or earnings. When considering historical performance, CBVs will normalize the historical results to reflect a maintainable range of cash flows or earnings, as discussed further in our Understanding Valuation Earnings Adjustments blog.

The Capitalized Cash Flow and Capitalized Earnings approaches are appropriate for:

- A business with unreliable or unavailable forecasts; and/or

- A mature business that is expected to continue to operate for the foreseeable future with cash flows and earnings that are expected to remain stable in the future.

The primary difference between a capitalized cash flow and capitalized earnings approach is whether capital expenditures are considered rather than relying on amortization and depreciation as a proxy for capital expenditures.

There are advantages and disadvantages to each of the aforementioned approaches, and the choice of approach may depend on a variety of factors, including the nature of the business and information available.

Discount Rates

Since CBVs, like anyone else, cannot see into the future, a discount rate is used to account for the underlying risk of the future earnings and cash flows. The discount rate also considers the time value of money, bringing the future cash flows and earnings into today’s dollars (the time value of money concept is discussed further in our blog, Money Now vs. Money Later). Determining an appropriate discount rate can be complex and requires professional judgement by the CBV. Factors considered in determining an appropriate discount rate include market conditions at the valuation date and company-specific risks, such as risks associated with the size, industry and operations of the company.

Putting It All Together

After an appropriate discount rate is determined by the CBV, it is applied to the expected earnings or cash flow to arrive at the going concern value of the company.

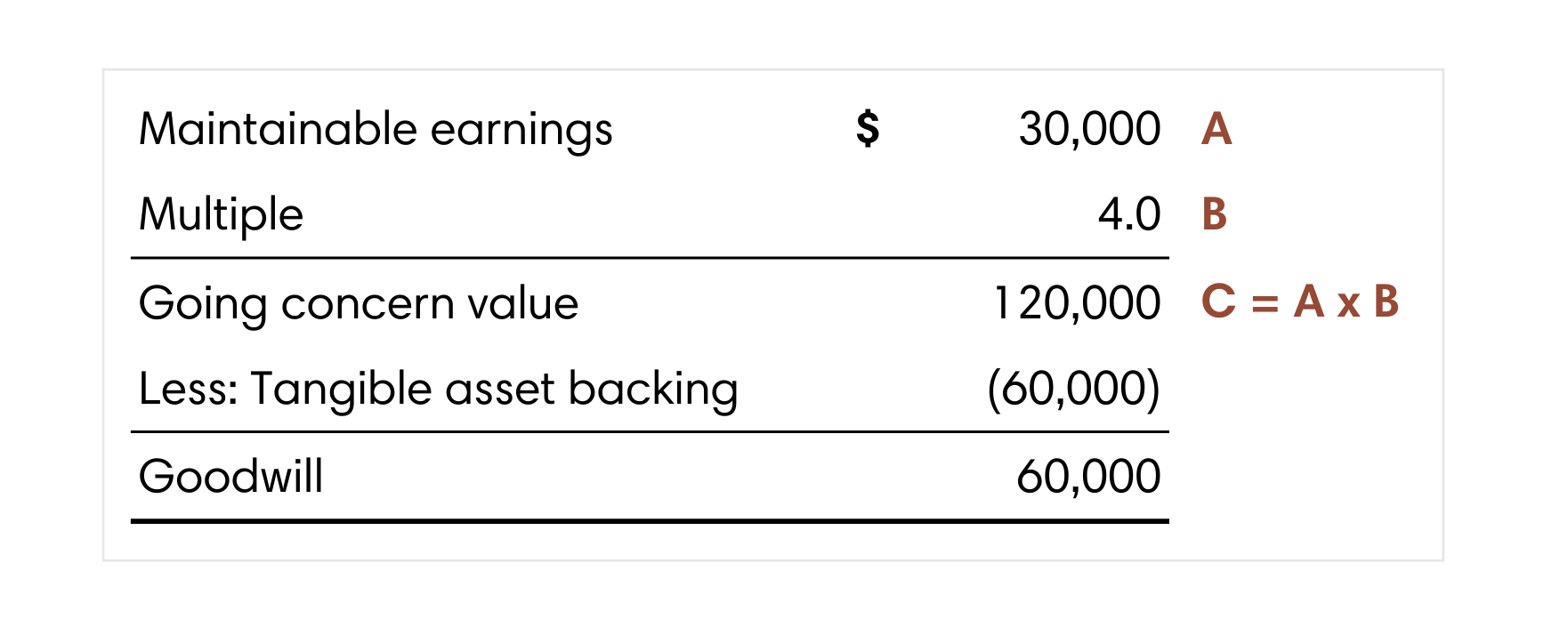

Going back to our example, let’s assume the appropriate discount rate determined by the CBV was 25%. We apply the discount rate to the maintainable cash flows through the multiple, determined as the inverse of the discount rate (1/25% = 4.0). This arrives at a going concern value of the company. To determine the goodwill, we deduct the tangible asset backing as shown below.

Takeaways

Income approaches are used when there is an expectation of goodwill in the business given the assumption that the cash flows or earnings generate value above the underlying assets. If that is not the case, an asset approach would be applied since the asset values would exceed the value generated from future cash flows or earnings. The asset approach is discussed further in our blog, Adjusted Book Value Approach.

If you need help navigating the complicated areas of business valuation, the experts at Davis Martindale can help you. Give us a call today for a personalized discussion.

Co-Authors

Ron Martindale

BASc., CPA, CA, CBV, CFF

Partner

Valuation & Litigation

Korab Ferati

CPA, CMA, CBV

Partner

Valuation & Litigation

Work With Us

Our Valuation Advisors are ready to have

a personalized discussion with you.