Eligible employees

The definition of “eligible employee” has been modified for claim periods 5 and on such that an employee is permitted to be without remuneration for 14 or more consecutive dates in a qualifying period. For claim periods 1 to 4, an eligible employee cannot be without pay for 14 or more consecutive days.

Baseline remuneration

Commencing with claim period 5, eligible remuneration is no longer tied to baseline remuneration for arm’s length employees. The amount of remuneration for active arm’s length employees will be based solely on actual remuneration paid in respect of the period.

For active non-arm’s length employees, the wage subsidy for period 5 and subsequent periods will be based on employee’s weekly eligible remuneration or pre-crisis remuneration, whichever is less, up to a maximum of $1,129. For period 5 and subsequent periods, pre-crisis remuneration is based on the average weekly remuneration paid from Jan 1 to March 15, 2020, or from July 1, 2019 to Dec 31, 2019. The method chosen can be made on an employee by employee basis.

What has not changed?

- Periods 1 – 4: No changes were announced related to the first 4 qualifying periods. Please see our previous post on eligibility https://www.davismartindale.com/updated-cews/

- Eligible remuneration: There are no proposed changes to the definition of eligible remuneration.

- Maximum overall subsidy per employer: There is no overall limit on the amount of subsidy that an eligible employer can claim

- Taxability of CEWS: CEWS is taxable to the eligible employer

- Revenue methodology: Eligible employers are allowed use of accrual or cash method to compute revenues for purposes of CEWS eligibility when an election is filed.

- Furloughed employees: The employer portion of EI and CPP in respect of furloughed employees will continue to be refunded to the employer.

Other announcements

The draft legislation also encompassed other previously announced changes including:

- Providing continuity rules for revenue declines on an asset purchase of a businesses or on an amalgamation

- Allowing prescribed organizations that are registered charities or non-profit organizations to choose whether to include government source revenue in computing revenue declines

- Allowing entities that use the cash method of accounting to elect to use accrual based accounting in computing revenue

- Allow employers with paymaster arrangements to qualify

- Provide an appeals process based on the existing procedure for notices of determination

CEWS Application Note

The CEWS application has been recently updated such that the applicant is required to indicate whether any elections have been made under subsection 125.7(1) or 125.7(4) of the CEWS program. We anticipate this question will be expanded to encompass the revised election options beginning with claim period 5. For period 1 to 4 claims, the applicant must select “yes” where any of the following elections have been made:

- a joint election, along with each other member of the group that prepares consolidated financial statements, to determine revenue on a non-consolidated basis for members of the employer’s group (125.7(4)(a))

- a joint election, along with each other member of the affiliated group, to determine revenue on a consolidated basis for the employer’s group (125.7(4)(b))

- an election for joint ventures (125.7(4)(c))

- a joint election, along with each person or partnership with which the employer does not deal at arm’s length and from whom the employer earns all or substantially all of its qualifying revenue under paragraph 125.7(4)(d) of the Income Tax Act

- an election to determine revenue using the cash method (125.7(4)(e))

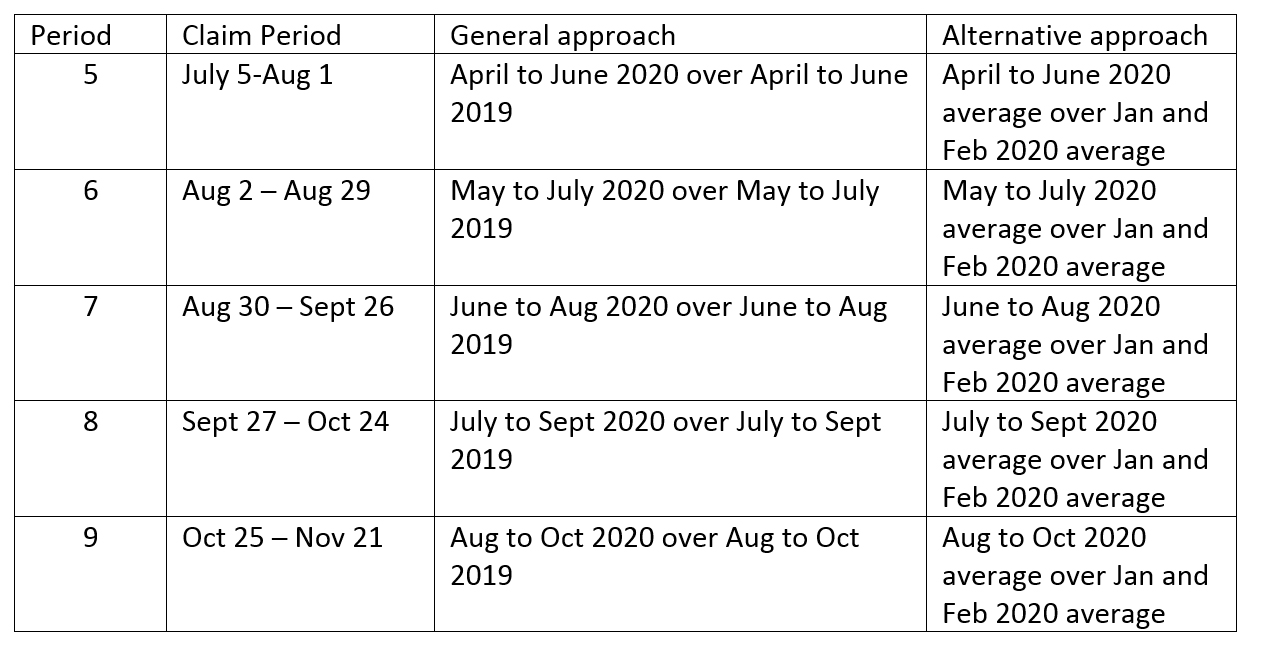

- an election to determine the prior reference period using the alternative approach (125.7(1)(b)(ii))

- an election by a registered charity or not-for-profit to exclude government funding (125.7(1)(a)(ii) or (b)(ii).

If none of these elections have been made, the question should be answered “no”. Form RC661 must be completed to certify and attest that the wage subsidy application is complete and the appropriate elections have been made (or no election is required).