The Building Blocks of Value: Redundant Assets

Redundant Assets

In Part 3 of our series on the building blocks of value, we take a closer look at redundant assets and why it is important to differentiate between a corporation’s redundant assets and other types of assets when determining the value of the operations of your business.

(Originally Posted June 9, 2020)

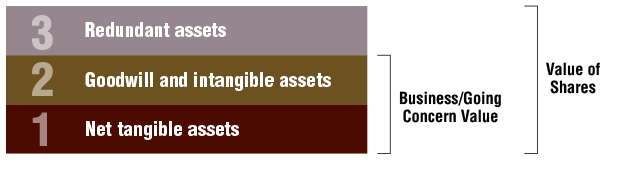

In a previous Davis Martindale blog (Valuation Components – Introduction to the Building Blocks of Value), we introduced the three types of assets that comprise the value of a corporation:

- Tangible Assets – the physical assets used in day-to-day operations;

- Redundant Assets – physical assets that are not required for day-to-day operations (non-operating assets); and

- Goodwill and Intangibles – non-physical assets that add value to your business, over and above the physical assets.

Redundant Assets – What Are They?

As referenced above, redundant assets are assets that are not integral to the operation of a business; however, they are still held within the corporation. As redundant assets are not required to operate a business, they may initially be excluded by a valuator when determining the value of business operations. Redundant assets are then added to the value of business operations when determining the value of the shares. As such, it is important to differentiate between a corporation’s redundant assets, and other types of assets in order to determine the value of business operations separately from the value of a corporation.

Examples of redundant assets range from liquid balance sheet items, such as excess cash and investments, to physical assets, such as a boat. If the assets in question were not used as a part of ongoing operations of the business, they would likely be considered redundant. For example, a boat may be considered redundant to the operations of the business, unless the business operates in industries such as commercial fishing, tourism, or other marine industries.

Redundant Liabilities – What Are They?

Redundant liabilities are Balance Sheet items which detract from the value of a corporation, above and beyond regular operating-type loans. If, in the example above, a loan was taken to purchase the redundant boat, then that loan would be considered a redundant liability.

A Simple Example

To illustrate the difference between a tangible asset and a redundant asset, consider again the ownership of a boat in two scenarios: a successful construction business which owns a boat used primarily by the corporation’s shareholder to visit their cottage, and another corporation which operates a boat tour business in cottage country.

In our first example, the construction corporation owner has decided to purchase a boat through the corporation for personal use. This boat is not required for business operations and, as such, is considered a redundant asset of the corporation. The value of the boat is added in addition to the value of the business operations.

In the second example, the tour company may own multiple vessels, all of which are used to provide tours to clients. Without the boats, the tour company cannot offer its services without fundamentally changing its operations. In this scenario, a boat is not a redundant asset, and is included within the value of the business operations.

If you need help navigating the complicated areas of business valuation, the experts at Davis Martindale can help you. Give us a call today for a personalized discussion.

Co-Authors

Louise Poole

CPA, CA, CBV, CFF

Partner

Valuation & Litigation

Korab Ferati

CPA, CMA

Associate

Valuation

Work With Us

Our Valuation Advisors are ready to have

a personalized discussion with you.