Understanding the Principal Residence Exemption and its Benefits

Understanding the Principal Residence Exemption and its Benefits

In this blog, we will discuss the principal residence exemption and its tax benefits, in addition to the determination of which property to allocate as your principal residence.

As housing prices continued to rise throughout the pandemic, many people may have taken advantage and sold their home, condominium, or cottage to earn a significant gain on their property. The question now is how will this gain impact the seller in the upcoming tax season? In this blog, we discuss the principal residence exemption and its tax benefits, in addition to the determination of which property to allocate as your principal residence.

What is the principal residence exemption?

The principal residence exemption allows an individual to allocate one property as their principal residence and, upon sale, the gain will be exempt from taxes. Properties that can be considered a principal residence include, but are not limited to, a house, cottage, trailer, and condominium. The property that you are designating as the principal residence, must have been ordinarily inhabited by the taxpayer, their spouse/common law partner, or child during the years of designation. If an individual owns more than one property, they are only permitted to allocate one property as their principal residence in any given tax year. The principal residence exemption is also shared between spouses and common law partners.

So how do you know which property to allocate as the principal residence?

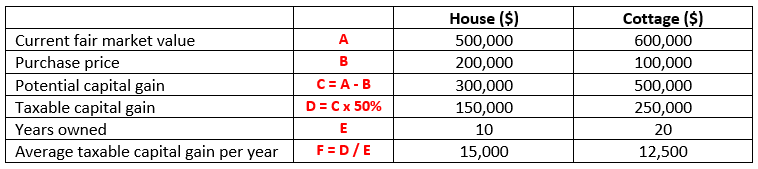

Let’s say Carter owns a house and a cottage; he purchased the house ten years ago and the cottage twenty years ago. Carter has now decided to sell both properties but is unsure which property to allocate as his principal residence for any of the years it was owned. Carter ordinarily inhabited both properties throughout each tax year. The capital gain is calculated as the difference between what was paid for the property and its selling price or fair market value. For tax purposes, only 50% of this capital gain is taxed, which is called the taxable capital gain. Below we calculate the average taxable capital gain per year for each property.

We determine the average taxable capital gain per year, which will help in determining which year to allocate the cottage and house as the principal residence for each given tax year. For the first 10 years of owning the cottage Carter would allocate this property as his principal residence. However, at the ten-year mark, when he purchased the house and owned two properties, he would then begin allocating the house as his principal residence as the average taxable capital gain per year is higher than the cottage, a difference of $2,500 ($15,000 – $12,500) per year. In this example, we assume Carter is single; however, if he was married, the principal residence exemption would be shared between him and his spouse.

Recording your sale on your T1 Personal Income Tax Return

When you sell a property and designate it as your principal residence, you are required to record the sale on your T1 Personal Income Tax Return. Information such as the date of purchase, the amount you sold it for, and what type of property was sold, are examples of information that you will be required to provide to complete your return.

If you have any questions about the principal residence exemption, the professionals at Davis Martindale have experience in all areas of accounting, taxation, and advisory services. Regardless of the challenges you and your business face, we have the expertise to assist you with overcoming any obstacles that stand in your way. Give us a call today for a personalized discussion.

Co-Authors

Work With Us

Our Valuation Advisors are ready to have

a personalized discussion with you.