Understanding the Lifetime Capital Gains Exemption and its Benefits

Understanding the Lifetime Capital Gains Exemption and its Benefits

In this blog, we discuss the lifetime capital gains exemption – a useful and generous tax planning tool that may spare you from paying taxes upon the sale of qualified small business corporation shares.

You have spent the last 20 years building a successful business and may be ready to sell and retire, but what are the tax implications upon sale? In this blog, we will discuss the lifetime capital gains exemption – a useful and generous tax planning tool that may spare you from paying taxes upon the sale of qualified small business corporation shares[1].

What is the lifetime capital gains exemption?

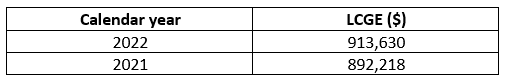

The lifetime capital gains exemption (“LCGE”) provides Canadian resident individuals with a significant tax benefit when disposing of qualified small business corporation shares (“QSBCS”). Upon disposal, 50% of the LCGE is netted against the taxable capital gain, eliminating some or all of the taxable capital gain. The table below lists the lifetime capital gains exemption limits for QSBCS.

The LCGE is increased annually by an inflationary amount.

What are Qualified Small Business Corporation Shares?

For shares to qualify as QSBCS, all of the following conditions must be met:

- The corporation is a Canadian Controlled Private Corporation.

- At the time of sale, more than 90% of the assets of the corporation (computed on a fair market value basis) are used principally in active business operations carried on primarily in Canada by the corporation or a related corporation, or are shares or debt of a connected corporation that meets the 90% test.

- The shareholder(s) needs to have owned the shares for a 24-month period preceding a sale (with some exceptions).

- In a 24-month period preceding a sale, 50% of the fair market value of the assets of the corporation are used principally in active business operations carried on primarily in Canada by the corporation or a related corporation, or are shares or debt of a connected corporation that meets the 90% test above.

It is imperative that upon selling your shares that all of these conditions are met to qualify for the exemption.

To illustrate how the LCGE works, let’s consider Bob who sells his QSBCS of ABC Inc. in 2022 for $1,000,000. Bob originally purchased the shares of ABC Inc. ten years ago for $90,000 and has never used his LCGE previously nor has he ever incurred a net investment loss. The after-tax proceeds are calculated as follows, with and without the use of the LCGE:

As the LCGE exceeds the taxable capital gain, Bob’s taxable income from the sale of ABC Inc. is $nil. Accordingly, Bob is able to save $243,562 ($1,000,000 – $756,438) of taxes when using his LCGE. As you can see there is a significant difference in the after-tax proceeds when Bob applies his LCGE. Additionally, as the LCGE is cumulative, Bob can apply the exemption until he reaches the limit.

If you have any questions about the LCGE, the professionals at Davis Martindale have experience in all areas of accounting, taxation, and advisory services. Regardless of the challenges you and your business face, we have the expertise to assist you with overcoming any obstacles that stand in your way. Give us a call today for a personalized discussion.

Co-Authors

Ron Martindale

BASc, CPA, CA, CBV, CFF

Partner

Valuation & Litigation

Robin Morrison

CPA

Associate

Valuation

Information Sources:

[1] Alternative Minimum Tax (“AMT”) may apply. AMT is beyond the scope of this article.

Work With Us

Our Valuation Advisors are ready to have

a personalized discussion with you.