The Building Blocks of Value: Goodwill and Intangible Assets

The Building Blocks of Value: Goodwill and Intangible Assets

Part 2 in our series on the Building Blocks of Value takes a closer look at the components of intangible assets and goodwill, including various factors that may influence the value of goodwill.

(Originally Posted July 16, 2019)

Read Part 1 in our Building Blocks of Value Series

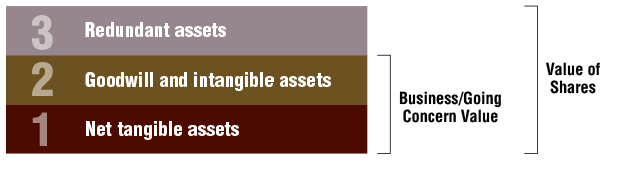

In a previous Davis Martindale blog (Valuation Components: Introduction to the Building Blocks of Value), we introduced the three types of assets that make up the value of a Company:

- Tangible Assets – the physical assets used in day-to-day operations;

- Redundant Assets – physical assets that are not required for day-to-day operations; and

- Goodwill and Intangibles – non-physical assets that add value to your business, beyond the physical assets.

As a business owner, one of your objectives should be to maximize the value of your goodwill and intangible assets. This not only ensures you will receive the maximum value when you decide to sell your business, but benefits you every year you continue to run the business. Let us look at a simplistic example.

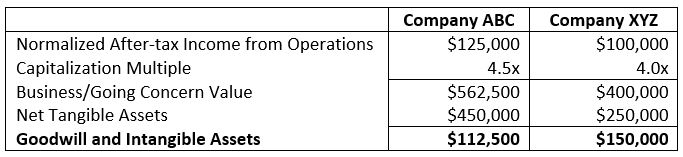

Consider two companies: Company ABC and Company XYZ. Both companies operate in the same industry, however Company ABC is larger – they have more assets and they earn more money.

To a passive observer, it may appear that Company ABC has more goodwill, since they make more money. But this is not always the case. Let’s take a closer look:

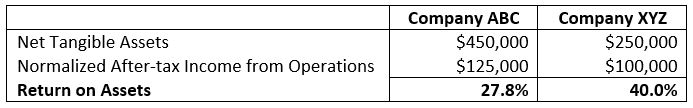

The above example highlights the importance of efficient use of business assets. It is true that Company ABC earns more money than Company XYZ; however, Company XYZ uses its assets more efficiently:

Efficient use of assets is one factor that influences the value of goodwill. Because each business is unique, your Chartered Business Valuator (CBV) will consider multiple factors when determining the value of the goodwill in your business. These factors may include some of the following:

- Location Goodwill – a business in a high traffic area may see increased sales;

- Product or Service Goodwill – a product that is well established in the market, or that has a favourable brand name, may see higher sales than a similar product by a competitor;

- General Business Goodwill – may include factors such as competent employees, an experienced management team, amicable relationships with suppliers, and so forth;

- Individual Goodwill – the advantage a business has by employing a person with key abilities, reputation, etc. If that person left the business and choose to compete, the profitability of the former business could be damaged; and

- Personal Goodwill – similar to individual goodwill, except it typically includes the key abilities and reputation of the business owner. Consequently, this form of goodwill is typically non-transferable, and has no commercial value.

While goodwill represents an asset that is more general and non-separable in nature, intangible assets are specifically identifiable assets, such as customer lists, brands, copyrights and intellectual property. Unlike goodwill, intangible assets can be transferred separately from the business.

Under most circumstances, intangible assets do not appear on a company’s balance sheet and have no recorded book value. It is important, therefore, for business valuators to pay special attention to these asset categories.

While goodwill and intangible assets are technically distinct, for practical purposes, valuators will often consider goodwill and intangible assets together.

Whether you are looking to value your business for purposes of sale, estate planning, matrimonial or anywhere in between, give the professionals at Davis Martindale a call. We have experience in all forms of valuation engagements.

Co-Authors

Ron Martindale

BASc, CPA, CA, LPA, CBV, CFF

Partner

Valuation & Litigation

Korab Ferati

CPA, CMA, CBV

Manager

Valuation & Litigation

Work With Us

Our Valuation Advisors are ready to have

a personalized discussion with you.