New financial relief packages have been announced both federally and provincially to support Ontario businesses. In addition, several new measures were announced related to tax remittance and filing deadlines.

Ontario Announcements

Highlights below, for complete details, see https://www.wsib.ca/en/novel-coronavirus-covid-19-update

WSIB (Workplace Safety and Insurance Board)

- Deferral of WSIB premium reporting and payments until Aug 31, 2020

- No interest will accrue on outstanding WSIB payments during deferral period

- Applies to Schedule 1 businesses as well as Schedule 2 organizations – publicly funded organizations and businesses who are involved in federally regulated industries

EHT (Employer Health Tax)

- Increase in EHT exemption for 2020 from $490,000 to $1,000,000

- Beginning after April 1, 2020, penalties and interest will not apply to Ontario businesses that miss any filing or remittance deadline (to Aug 31, 2020).

- Audit activity will be suspended for the month of April 2020.

- See link for other Ontario taxes included in the relief period

Federal Announcements

Prime Minister Trudeau announced support for small businesses facing impacts of COVID‑19. Highlights below, for complete details, see: https://www.canada.ca/en/department-finance/news/2020/03/additional-support-for-canadian-businesses-from-the-economic-impact-of-covid-19.html

WAGE SUBSIDY:

The federal government is increasing the previously announced payroll subsidy to small business. The government will now cover up to 75% of salaries (a major increase over the original 10% subsidy). Subsidy to be retroactive to March 15. Further details to be announced but eligibility expected to follow previous announcement. https://www.canada.ca/en/revenue-agency/campaigns/covid-19-update/frequently-asked-questions-wage-subsidy-small-businesses.html

CANADA EMERGENCY BUSINESS ACCOUNT:

Interest free loans of up to $40,000 to small businesses and not for profits to help cover the operating costs during a period where revenues are temporarily reduced due to COVID-19. Eligible organizations have 2019 annual payroll of $50,000 to $1 million.

GST/HST DEFERRAL:

To further support businesses, the government is extending the payment deadlines to June 30, 2020. The extended payment deadlines will cover:

- Monthly filers have to remit amounts collected for the February, March and April 2020 reporting periods;

- Quarterly filers have to remit amounts collected for the January 1, 2020 through March 31, 2020 reporting period; and

- Annual filers, whose GST/HST return or instalment are due in March, April or May 2020, have to remit amounts collected and owing for their previous fiscal year and instalments of GST/HST in respect of the filer’s current fiscal year.

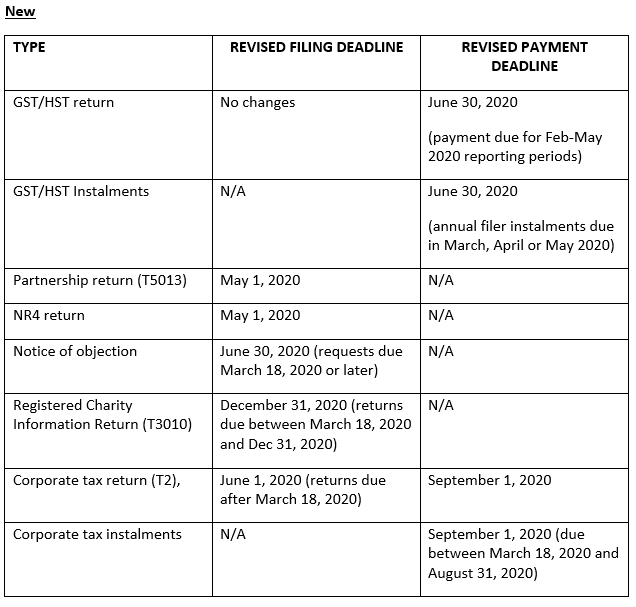

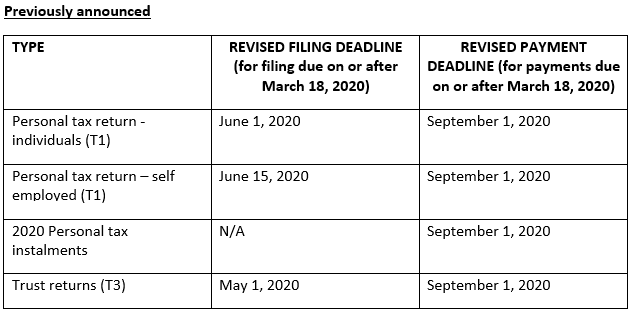

PAYMENT AND FILING EXTENSIONS:

In addition to income tax filing and payment deadline extensions previously announced, the following additional administrative tax measures were announced. Below is a summary of the significant extensions.