Expanded Trust Reporting Rules for 2023

New rules effective for trusts with tax years ending on or after December 31, 2023 will require enhanced disclosure and most trusts will be required to file a tax return.

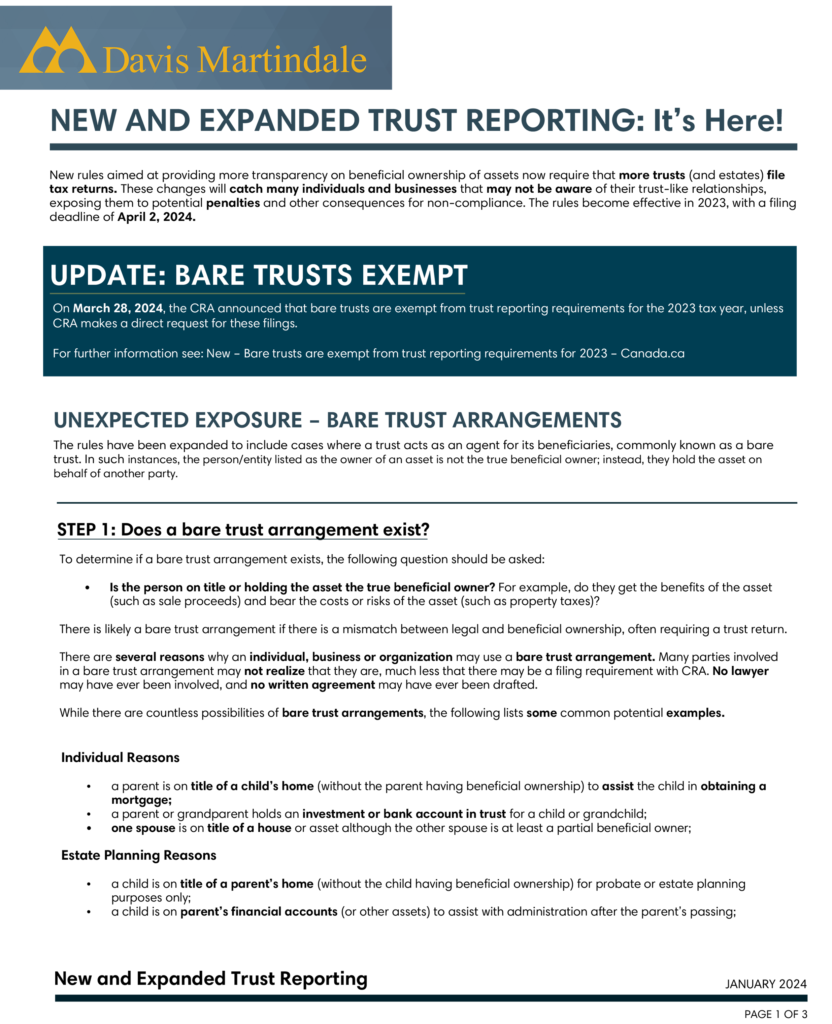

Update: Bare Trusts Exempt

On March 28, 2024, the CRA announced that bare trusts are exempt from trust reporting requirements for the 2023 tax year, unless CRA makes a direct request for these filings.

For further information see: New – Bare trusts are exempt from trust reporting requirements for 2023 – Canada.ca

The new disclosure rules apply to trust-like relationships whereby a person holding legal title to an asset differs from the beneficial owner, commonly known as a bare trust.

New CRA Guidance: 2023 Penalties Waived for Late-Filed Bare Trusts

On March 12, 2024, the CRA released new guidance indicating that a bare trust with a late-filed 2023 T3 return:

- Will not be assessed late-filing penalties, unless due to gross negligence; and

- Will not be assessed the new penalty for false statements or omissions, except in the case of egregious gross negligence, and only after mandatory approval by CRA Headquarters.

See Questions 3.5 and 3.6 in the FAQ section of New reporting requirements for trusts: T3 returns filed for tax years ending after December 30, 2023 – Canada.ca

The above waivers apply only to bare trusts and only for the 2023 tax year.

The amount of the new penalty is the greater of $2,500 and 5% of the value of the trust’s assets. Previously, the CRA’s guidance stated that this penalty would be waived for bare trusts for the 2023 tax year, unless the failure was made knowingly or due to gross negligence.

Prior to 2023, bare trusts were not required to file a T3 return. Bare trusts are now required to file a T3 return in order to report the information required under the Expanded Trust Reporting Rules.

Check out these other resources on expanded trust reporting:

- The New Trust Filing Rule Could be a Real “Bare” to Deal With – DFK Tax Digest, 2023 Issue Four.