Accounting for Disposition Costs in Family Law: When to Apply Sengmueller

Accounting for Disposition Costs in Family Law: When to Apply Sengmueller

In this blog, we discuss contingent disposition costs within family law, and explain the circumstances under which they should be considered and valued.

Valuations are complicated, and valuators frequently deal with a myriad of issues. One issue that often arises when valuing a business are contingent disposition costs.

In a previous Davis Martindale Blog (Free and Clear? Understanding Contingent Disposition Costs), we discussed some of the potential disposition costs that may be incurred when selling a business’s assets or shares (“business”). Commissions paid to real estate agents, broker fees paid to advisors that sell your business, and taxes owing from the sale of your business are just a few examples of potential disposition costs. To complicate the matter further, because of the time value of money (a topic we discuss in our blog Money Now vs Money Later), these costs must often be considered at their present value.

Disposition Cost Options

- Include the full cost because the cost is expected to be incurred immediately.

- Don’t include the cost because either the costs will be incurred so far in the future that they are irrelevant, or because tax planning will be used to defer the costs far in the future.

- Discount the cost somewhere in between because disposition will occur at some point between the immediate present and the distant future. This decision is discretionary and dependent on specific circumstances. If the expected timing can’t be reasonably determined, a middle ground inclusion of 50% of the costs may sometimes be used.

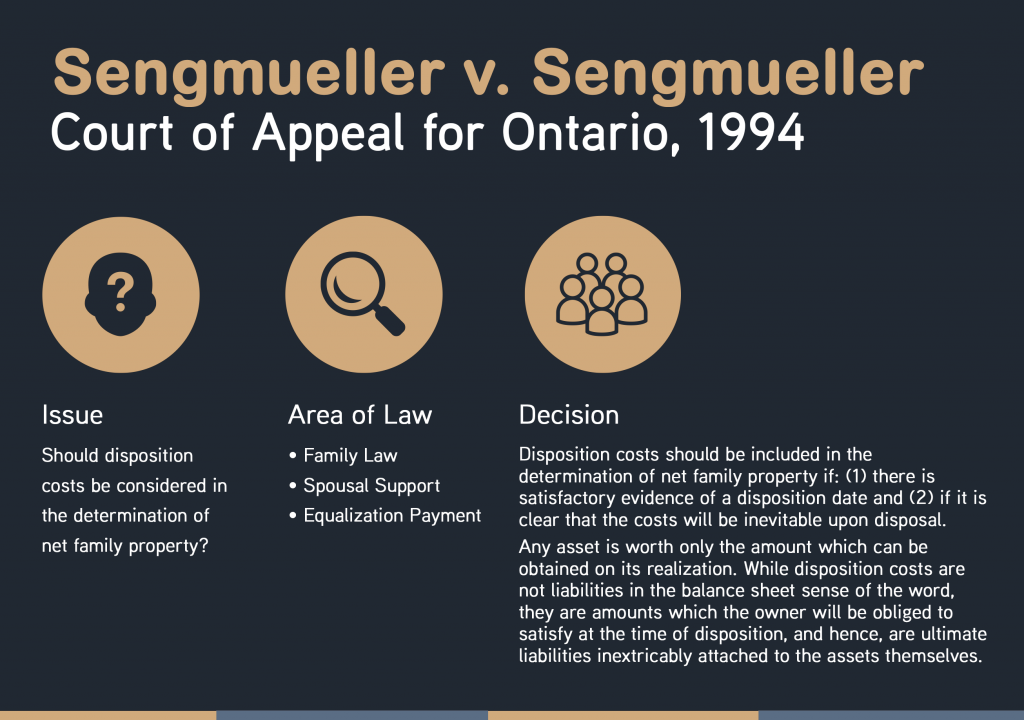

To discuss the circumstances of when these costs should be included and in what quantum, we consider the Sengmuller v. Sengmuller case (1994 ONCA).

Sengmueller v. Sengmueller (1994 ONCA)

The leading court case in Canada on the topic of contingent disposition costs is Sengmueller v. Sengmueller. Often referred to by business valuators and legal professionals as the “Sengmueller Discount” the underlying principle of the court case is that a corporation’s eventual disposal costs should be taken into account when determining net family proper under the Family Law Act.

Corporations often have built in disposal costs. When they are eventually sold or wound-up, the owner of the corporation will likely have to pay corporate taxes, commissions and selling fees. These fees will need to be present valued to account for the time value of money, and may be considered in either the valuation of the assets themselves, or as a liability existing on the valuation date.

When Sengmueller Should be Applied

According to Sengmueller, disposition costs should be included if:

- It is clear the costs will be inevitable upon disposal; and

- There is satisfactory evidence of a disposition date.

Under most normal circumstances, the first hurdle is very easy to overcome. Most appreciating assets, such as stocks and land, will have taxes payable upon their disposal. Depending on the circumstance, they may also have commissions and selling fees.

When there is reasonable evidence of a disposition date, the business is deemed to be disposed of on that date. Disposition costs and any taxes payable will be estimated and adjusted for the time value of money to the date of the valuation.

In the absence of satisfactory evidence of a disposition date, or when the eventual disposition is assumed to be so far in the future that it is irrelevant, disposition costs are typically not applied. We understand that each case should be dealt with on its own facts and circumstances.

If you need help navigating the complicated areas of disposition costs within Family Law, the experts at Davis Martindale can help you. Give us a call today for a personalized discussion.

Co-Authors

Ron Martindale

BASc, CPA, CA, CBV, CFF

Partner

Valuation & Litigation

Louise Poole

CPA, CA, CBV, CFF

Partner

Valuation & Litigation

Work With Us

Our Valuation Advisors are ready to have

a personalized discussion with you.