Introduction to Personal Tax in Canada – Part II

Introduction to Personal Tax in Canada – Part II

In this blog, we discuss some of the more complicated sources of personal tax in Canada and shed some light on the nuances of their tax treatments.

(Updated with current content from our original post on March 17, 2020)

In the most basic sense, taxable income is a proxy for the value you have received during the year, and for which you are required to pay income tax on. While most Canadians are familiar with the concept of income tax and taxable income, at least in principle, many Canadians find income taxes to be a complicated and confusing area of their lives. Two common areas of confusion many Canadians face when filing their taxes are whether certain sources of income received should be included in their taxable income, and why different sources of income are subject to different levels of tax.

In this series, we will be addressing these questions – and others. Part 1 of our series (Introduction to Personal Tax in Canada – Part I), introduced the following sources of income and the corresponding tax treatments:

- Employment Income vs. Self-Employment Income;

- Commissions and Other Employment Income;

- Interest and Other Investment Income; and

- Capital Gains vs. Taxable Capital Gains.

Part 2 will take a deeper dive into three of the more complicated areas of taxable income in Canada: dividends, support and old age security.

Eligible Dividends vs. Non-Eligible Dividends

A corporation may issue dividends from its after-tax proceeds. To avoid double-taxation, the CRA developed a method to allow the dividend recipient to claim a credit for the tax portion paid by the corporation. This mechanism is referred to as a dividend “gross-up”. The function of a dividend gross-up is to account for the portion of tax that a corporation has already paid. In effect, the amount reported as income on your tax return is more than the actual amount of the dividend received; however, the tax payor will receive a corresponding personal tax credit to reduce the overall taxes payable.

There are two types of dividends: Eligible and Non-Eligible

- Eligible Dividends are paid from a corporation to the extent their income is subject to general business tax rates (currently 26.5%).

- Non-Eligible Dividends are paid from a corporation to the extent their income is subject to tax at the small business rate (currently 12.2%). In general, non-eligible dividends are only available from Canadian Controlled Private Corporations (“CCPC”).

In theory, a business owner should be able to receive the same after-tax proceeds, regardless of whether they draw a dividend or a salary.

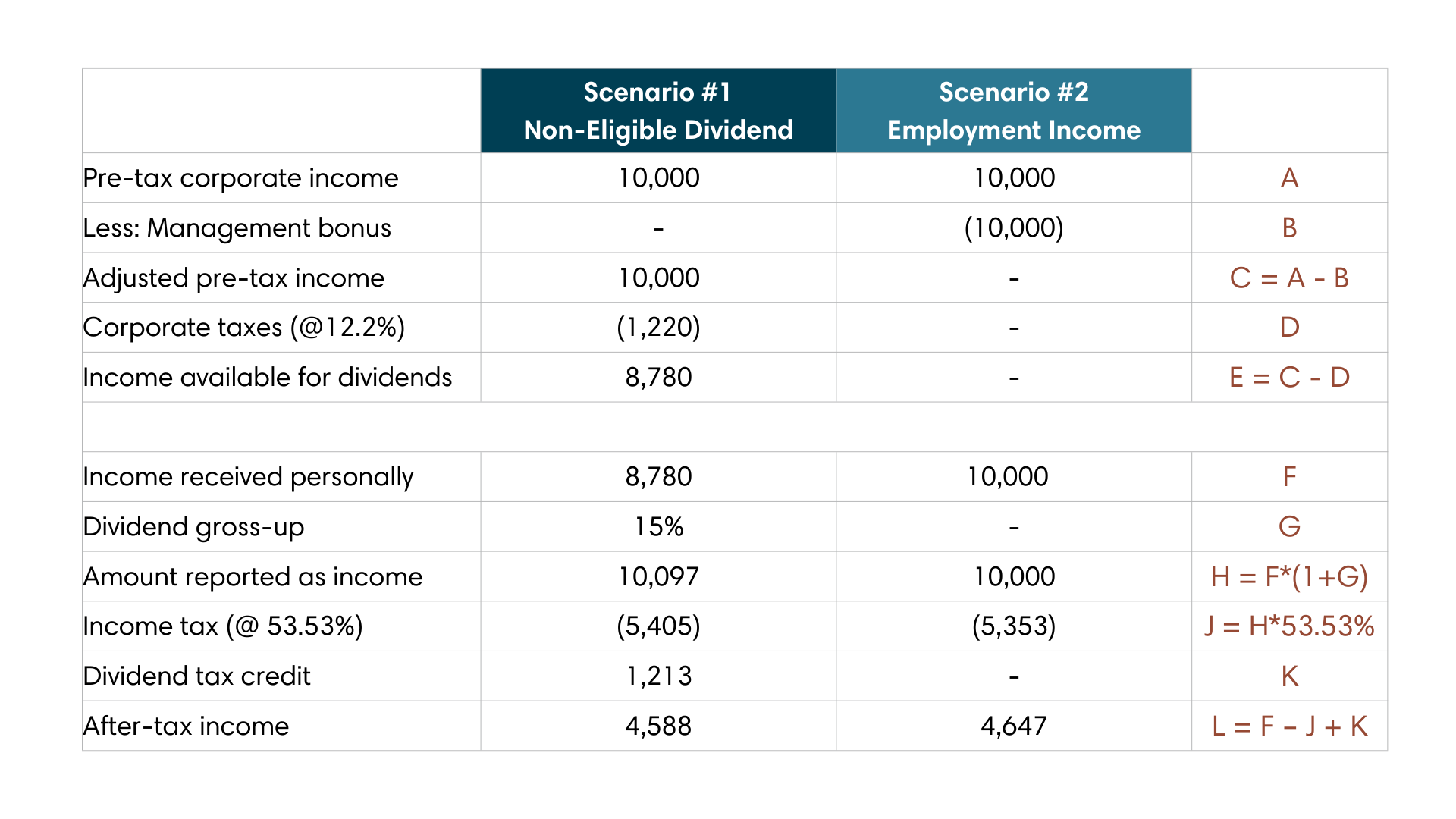

As an example, ABC Corporation (eligible for the Small Business Deduction) has net income of $10,000 at the end of the fiscal year. The owner, Mr. Smith, is deciding whether he should take a bonus or pay himself a dividend. Let us take a closer look:

Disclaimer: this example assumes Mr. Smith is at the top marginal tax bracket, and excludes any potential CPP, EI and RRSP considerations. As you can see above, even though Mr. Smith paid both corporate and personal income tax in Scenario #1, the after-tax income is almost identical to Scenario #2.

Child vs. Spousal Support

In Canada, child support is not tax deductible to the payor, nor is it treated as taxable income to the recipient. In contrast, spousal support is tax deductible to the payor and included as taxable income for the recipient. However, if the spousal support payment is a lump sum or if the payment is not court mandated it is not tax deductible to the payor and not included as taxable income for the recipient. Certain exceptions exist to the rules when dealing with cross-border support (i.e. when one spouse is a Canadian resident, and the other is a U.S. resident).

Old Age Security[1]

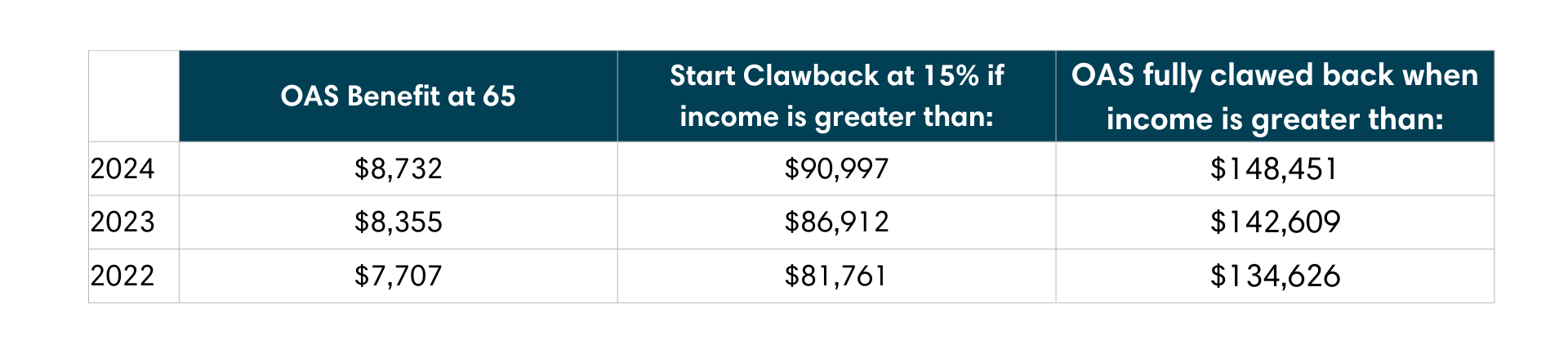

Old Age Security (“OAS”) is funded through general tax revenues – meaning you do not pay into the program. Individuals will typically start collecting OAS at age 65 but may defer it for up to 60 months (five years). We note the benefit of deferring OAS payments results in an increase of the amount received by 0.6% per month. The amount of OAS received is determined by the federal government. If an OAS recipient’s total income exceeds a specified threshold, the income is reduced by 15% of the excess, until the full amount of the OAS is clawed back.

Final Thoughts

It has been said that nothing is certain except for death and taxes – and while income taxes may be unavoidable, taking the necessary steps to understand taxes in Canada will better equip you, the Canadian taxpayer, to deal with this complicated and confusing area of your life.

With April 30 just around the corner, don’t forget to file your tax returns!

Disclaimer – The information provided in this publication is intended for general purposes only. Care has been taken to ensure that this information herein in accurate, however, no representation is made as to the accuracy thereof. The information should not be relied upon to replace specific professional advice.

[1] The table does not consider the 10% enhanced OAS payments starting at 75 years of age.

Explore other related blogs:

Co-Authors

Louise Poole

CPA, CA, CBV, CFF

Partner

Valuation & Litigation

Janece Boersma

CPA, CBV

Senior Manager

Valuation & Litigation

Work With Us

Our Valuation Advisors are ready to have

a personalized discussion with you.