Introduction to Personal Tax in Canada – Part I

Introduction to Personal Tax in Canada – Part I

In this blog, we introduce the common sources of personal tax in Canada and shed light on the nuances of their tax treatments.

(Updated with current content from our original post on March 10, 2020)

Despite the recent push towards the promotion of financial literacy education in Primary and Secondary Schools, many Canadians feel ‘in the dark’ when it comes to understanding personal income taxes. A poll conducted by CIBC[1] indicated that more than half of Canadians are unaware that they are required to pay tax on interest income earned on an everyday savings account. The same poll concluded that 77% of Canadians are unaware that dividends and capital gains may be taxed at lower rates than other sources of investment income.

With the goal of promoting financial literacy and a better understanding of the rules surrounding Canadian Taxation, please join us as we discuss the common sources of personal tax in Canada.

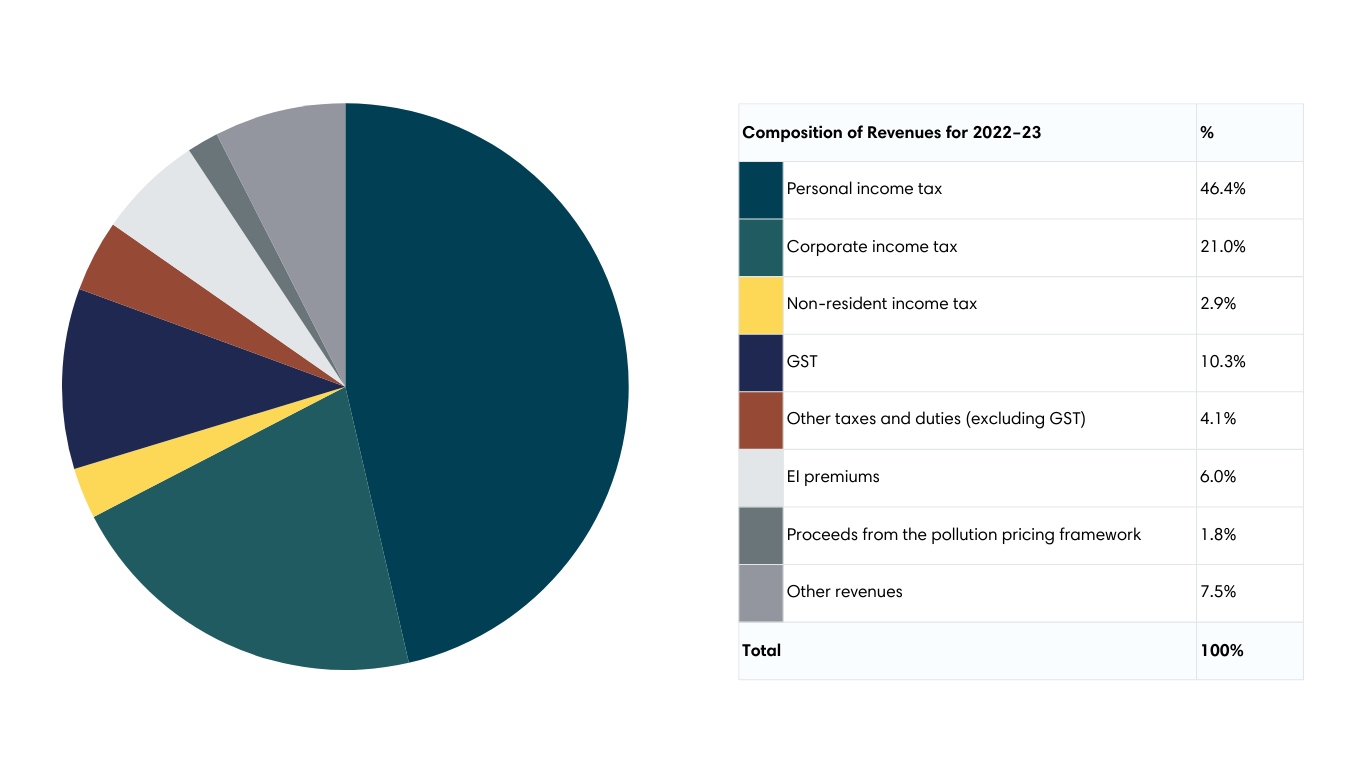

Federal Composition of Revenues

To highlight the main sources of Federal Government revenue we have included an excerpt of the 2022-2023 composition of revenues ($447.8 billion)[2]:

Employment Income vs. Self-Employment Income

While subtle, self-employed people have slightly different tax consequences than regular employees. The income tax rates are identical; however, self-employed persons are required to make twice the contribution toward the Canada Pension Plan (“CPP”) (11.9% vs. 5.95%)[3]. On the upside, self-employed persons may not be required to contribute to Employment Insurance (“EI”), unless they specifically opt in. Of course, this also means they are not eligible to collect EI if things take a turn for the worse.

Commissions and Other Employment Income

Treated the same as regular employment income – income taxes and source deductions (CPP and EI) are required to be deducted from commissions earned and other employment income.

Interest and Other Investment Income

Interest, foreign interest and dividend income, foreign sourced income, foreign sourced non-business income and other specific types of income are all reported in this section of your tax return. Financial Institutions may not issue you a T5 slip if your interest income is less than $50, but you must still report this income on your tax return.

Capital Gains vs. Taxable Capital Gains

Generally, when you sell a capital asset for more than you paid for it, you trigger a capital gain. The capital gain is equal to the difference between what you purchased the asset for, and what you sold it for.

On April 16th the 2024 Federal Budget was announced, which indicated that the capital gains inclusion rate had changed after more than two decades. As of June 25, 2024, the capital gains inclusion rate for individuals increased to 66.67% from 50%. However, the first $250,000 of capital gains per year is subject to the 50% inclusion rate, and any portion exceeding this amount incurs the 66.67% inclusion rate.

So, in short, a Capital Gain is the full amount of the proceeds less the initial cost, and a Taxable Capital Gain is the portion of the capital gain subject to income tax.

Some exceptions to the general rule include listed personal property, certain types of depreciable assets used in a business, and a home or cottage to which the principal residence exemption applies.

Conclusion

As the first part of our two-part series, this blog introduces common sources of personal tax in Canada. Stay tuned for part two of this series coming out in January 2025, where we take a deeper dive into three of the more complicated areas of taxable income in Canada: dividends, support and old age security.

If you are having difficulty navigating the world of Canadian Taxation, you’re not alone. Give the experts at Davis Martindale a call – we have experience working with clients of all knowledge levels.

Disclaimer – The information provided in this publication is intended for general purposes only. Care has been taken to ensure that this information herein is accurate, however, no representation is made as to the accuracy thereof. The information should not be relied upon to replace specific professional advice.

Co-Authors

Work With Us

Our Valuation Advisors are ready to have

a personalized discussion with you.