Intercompany Dividends in Income for Support

Intercompany Dividends in Income for Support

In this blog, we will explore the complexities surrounding intercompany dividends and how they impact an individual’s income for support calculations.

The movement of money between companies can be a difficult and complex exercise to understand when calculating income available for support. For example, let’s take a look at Ms. Crane who is currently going through a separation and owns two companies: Company A and Company B. Company A generated a $100,000 profit, from which it paid an $80,000 dividend to Company B. In turn, Company B then paid Ms. Crane a $40,000 dividend. Wow – that’s a whole lot of money changing hands! In this case it is essential to understand where the funds first originated to ensure they are not being double counted as they flow between companies.

In this blog, we explore the complexities surrounding intercompany dividends and how they impact an individual’s income available for support.

Income for Support

The Federal Child Support Guidelines state that subject to sections 17 to 20, a spouse’s annual income is determined using the sources of income set out under the heading line 15000 in the T1 General form issued by the Canada Revenue Agency, adjusted in accordance with Schedule III. This is generally applicable if the spouse does not hold a share interest in a privately held corporation.

However, what if the spouse does hold an ownership interest in a privately held corporation?

The Federal Child Support Guidelines dictate that all or some of the corporate pre-tax income may be available for support purposes. When determining the amount of corporate pre-tax income that may be available, it is important to consider the following:

- Income earned by the corporation, adjusted in accordance with the Federal Child Support Guidelines;

- The funds available to be withdrawn from a corporation; and

- Dividends paid from a corporation.

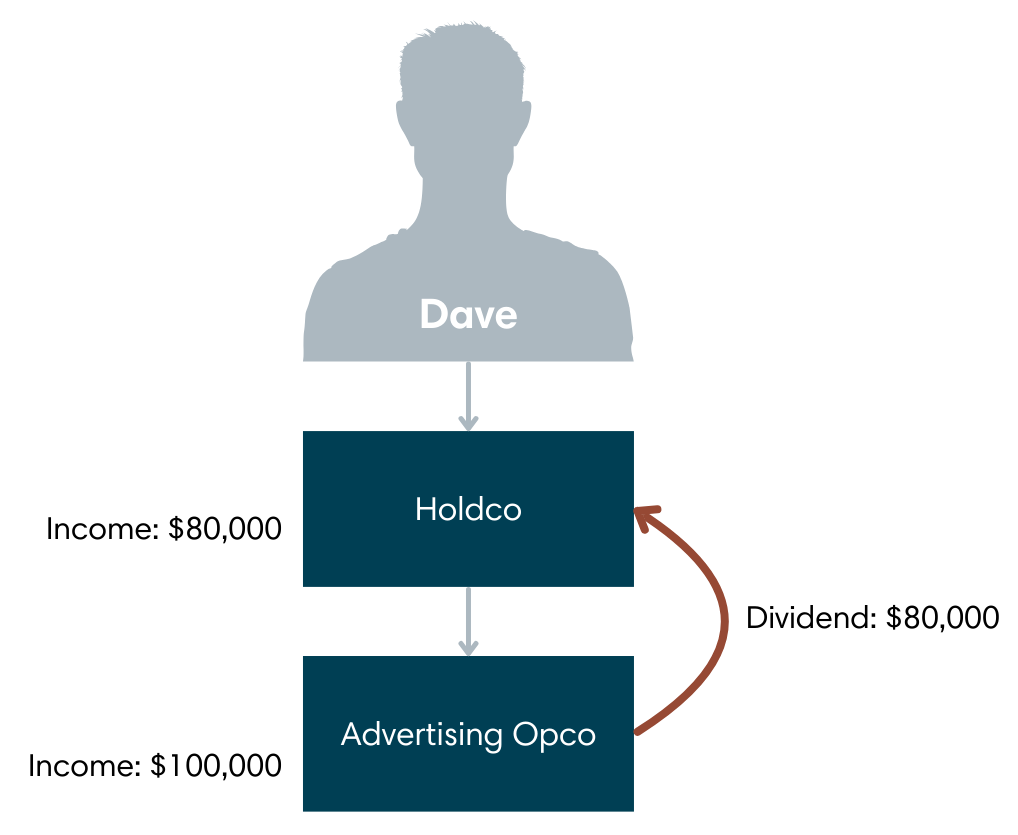

Today, we will be focusing on dividend payments and how they can create confusion in income for support calculations, particularly when multiple corporations are involved. To assist, we are going to look at the following example of Dave who owns an advertising company, but indirectly through a holding company.

Dave’s advertising agency earned $100,000 throughout the year and paid an $80,000 dividend to the holding company. As a result of this dividend payment, the holding company shows an income of $80,000.

While it may initially appear that there is a total of $180,000 in income—$100,000 from the advertising agency and $80,000 from the holding company’s dividend—the reality is that the $80,000 dividend is simply a transfer between entities. As a result, the actual income available to Dave is the $100,000 earned by the advertising agency. This distinction between income and a transfer of funds is critical to understand for accurately calculating income for support, as only the $100,000 represents true earnings.

Ensuring Fairness in Spousal Support Calculations

In scenarios involving multiple companies, it’s essential to accurately account for the actual income available for support. As demonstrated, while the dividends paid between companies might suggest a higher available income at first glance, a thorough analysis reveals the true income available to the shareholder. By correctly handling intercompany dividends, we can ensure that income is neither overstated nor understated, accurately reflecting what is available for support purposes while safeguarding the financial interests of all parties involved.

If you need help navigating the complicated area of income for support calculations, the experts at Davis Martindale can help you. Give us a call today for a personalized discussion.

Co-Authors

Ron Martindale

BASc., CPA, CA, CBV, CFF

Partner

Valuation & Litigation

Taylor Cornwall

MBA

Associate

Valuation

Work With Us

Our Valuation Advisors are ready to have

a personalized discussion with you.