The Building Blocks of Value: Net Tangible Assets

The Building Blocks of Value: Net Tangible Assets

Part 3 in our series on the Building Blocks of Value takes a closer look at a Company’s net tangible assets.

(Originally Posted September 10, 2019)

Read Part 1 in our Building Blocks of Value Series – Introduction

Read Part 2 in our Building Blocks of Value Series – Goodwill and Intangible Assets

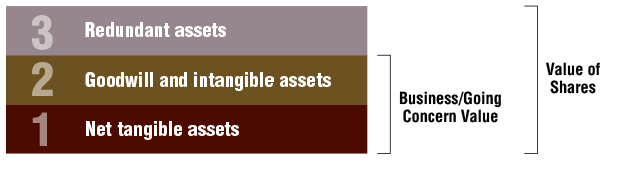

In a previous Davis Martindale blog (Valuation Components – Introduction to the Building Blocks of Value), we introduced the three types of assets that make up the value of a Company:

- Tangible Assets – the physical assets used in day-to-day operations;

- Redundant Assets – physical assets that are not required for day-to-day operations; and

- Goodwill and Intangibles – non-physical assets that add value to your business, beyond the physical assets.

When selling your business, potential purchasers are typically interested in purchasing two kinds of assets: tangible assets, and goodwill and intangibles. Our last blog (Valuation Components – Goodwill and Intangible Assets) covered goodwill and intangible assets. This blog will focus on tangible assets.

The tangible assets of a Company represent the fair market value of physical assets used by the company for day-to-day operations. Unlike goodwill and intangibles, the tangible assets focus exclusively on physical assets such as tools and equipment, inventory, accounts receivable, and sometimes cash.

As an important caveat, tangible assets do not include redundant assets, which are not part of active business operations. As an example, a corporation that holds public stocks and securities usually does not require these assets for day-to-day operations. A potential purchaser is, therefore, unlikely to be interested in acquiring them, and they may be excluded from the going-concern value of the business.

The measurement of a company’s tangible assets is important because it allows business owners and investors to analyze the position of a company without needing to consider redundant assets, or difficult-to-value intangible assets. A company’s return on assets, for example, is often more accurate when tangible assets are used in place of total assets. Further, a company with higher tangible assets may have more assets available to pledge as security, thereby increasing financing potential and reducing the going concern risk of the entity.

The relevance of tangible assets as an analytic tool varies across industries. Machine shops and manufacturers, for example, may have a high value of net tangible assets relative to the overall value of the business, while a software company may have a much lower ratio of tangible assets to overall value. It is therefore important to consider industry-specific factors when determining the appropriateness of tangible assets.

For valuation purposes, Chartered Business Valuators will often use a variation of the concept, called net tangible assets. As the word “net” implies, it considers tangible assets in excess of liabilities (excluding redundant liabilities) as a measurement tool. This is an especially useful metric for buyers and sellers, as it considers both the tangible assets and liabilities of a company together.

If you are looking for insights into the valuation process of your business, contact the experts at Davis Martindale for a personalized discussion.

Co-Authors

Ron Martindale

BASc, CPA, CA, CBV, CFF

Partner

Valuation & Litigation

Robin Morrison

CPA

Associate

Valuation

Work With Us

Our Valuation Advisors are ready to have

a personalized discussion with you.