Employees Working from Home in 2023

Employees who have worked from home more than 50% of the time for at least four consecutive weeks in 2023 may be eligible to claim a deduction for home office expenses. Follow the attached instructions as a simplified guide to assist in determining your claim.

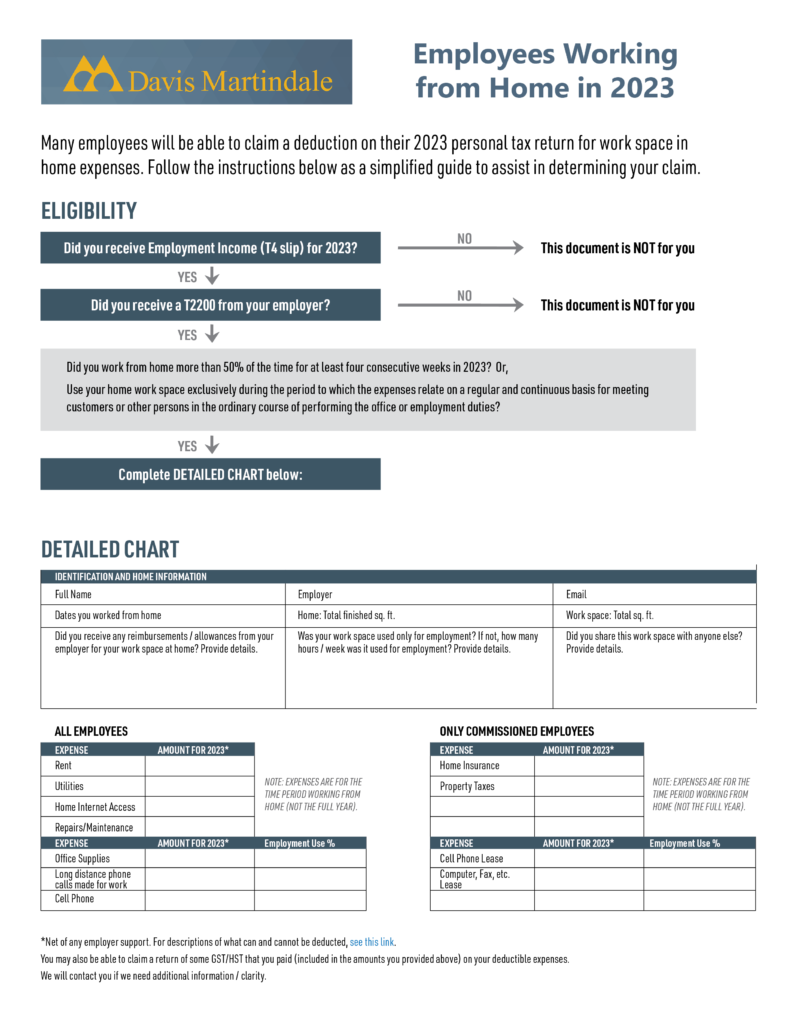

Please click on the image to download the fillable PDF.

Note: The temporary flat rate method available from 2020 to 2022 is not available for the 2023 tax year.

Eligible employees who are looking to claim home office expenses for 2023 must use the detailed method. To do so, they need to have a completed Form T2200, Declaration of Conditions of Employment, reviewed and signed by their employer.

How much to claim? To help employees determine how much they can claim, they can use the CRA calculator to calculate eligible expenses. For more information, go to CRA’s Expenses you can claim.