2023 Federal Budget Highlights

March 29, 2023

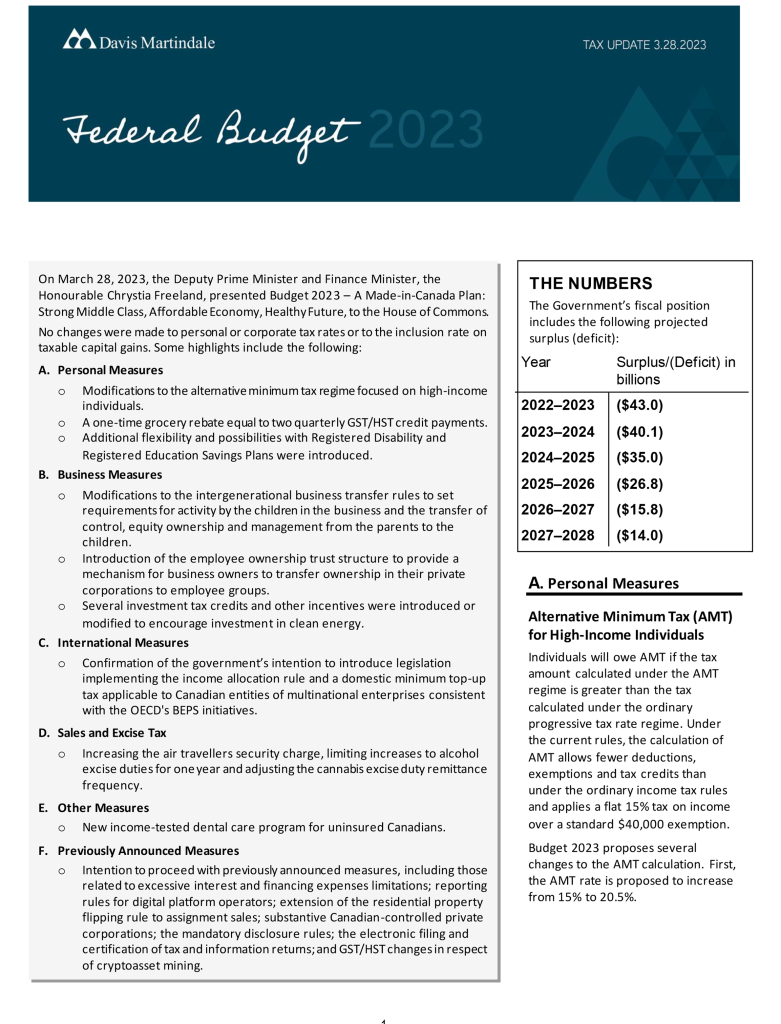

On March 28, 2023, the Federal Government tabled Budget 2023, which proposed a broad array of provisions impacting many individuals and businesses. The Budget did not include any changes to the personal or corporate tax rates or the inclusion rate on taxable capital gains.

Some of the items of interest include the following:

- Intergenerational Business Transfers – Amendments were introduced to ensure that relieving provisions (implemented in Bill C-208 in 2021) will only apply to genuine intergenerational business transfers, requiring:

- control by the child,

- activity of the child in the business, and

- active business continuing through a 3 or 10-year term, depending on the situation.

- Introduction of employee ownership trusts to facilitate business sales to employees.

- Significant modifications to the alternative minimum tax (AMT) to target high-income earners.

- Modifications to RESPs and RDSPs to add additional flexibility.

For further information, please contact your Davis Martindale advisors – we are available and ready to assist you!

To view and download the entire Federal Budget summary, please click on the image below.