Trusts: Part I – Introduction

Trusts: Part I - Introduction

In this blog, we provide an introduction to the basics of family trusts and touch on how family trusts may impact family law proceedings.

Trusts and trust funds may sound like a complex financial arrangement reserved for the wealthy; however, trusts are a common estate and tax planning tool used by many. In this blog, the first in a two-part series, we provide an introduction to the basics of family trusts and touch on how family trusts may impact family law proceedings.

What is a Trust?

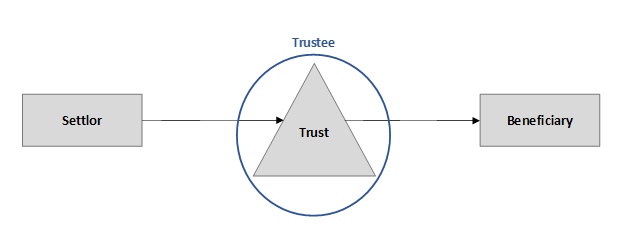

A trust is a legal arrangement in which assets are held in trust on behalf of one or more beneficiaries. To establish a trust, three main parties are involved: the settlor, the trustee, and the beneficiary.

Settlor

The settlor establishes the trust through the transfer of assets to the trust; this is referred to as settling the trust or the trust settlement. In the trust agreement, or trust deed, the settlor indicates how the assets of the trust are to be managed and who is to benefit from the assets.

Trustee

There may be one or more trustees, or executors, who hold the assets in trust on behalf of the beneficiaries. The trustee has control over the assets in the trust and the distribution of income from the trust.

Beneficiary

The property of the trust is held for the benefit of one or more beneficiaries. There are generally two types of beneficiaries:

- Capital beneficiaries: have rights to the underlying assets, or capital, within the trust; and

- Income beneficiaries: have rights to the income generated by the capital within the trust.

Trust Settlement

As mentioned above, the settlor of a trust establishes the trust through the trust settlement. In this process, the trust deed, or trust indenture, is created. The trust deed outlines the settlor’s instructions for the trust, including the following:

- Names of the trustees;

- Process for appointing new trustees or removing trustees;

- Name of the beneficiaries;

- Process for adding and removing beneficiaries;

- How the assets of the trust are to be managed; and

- How the income from the trust is to be distributed.

Purposes of a Trust

Trusts may be established for a number of reasons. Trusts can allow for the passing of wealth to future generations, while protecting the underlying assets. Trusts can also provide protection of assets from creditors. Many trusts are established for tax planning purposes, as a trust can distribute income to beneficiaries who may be at lower marginal tax rates. While the introduction of Canadian tax legislation, effective January 1, 2018, impacted many income-splitting structures established with trusts, trusts continue to be an important tool in achieving tax and estate planning objectives.

Family Trusts and Family Law

So how do trusts impact family law matters?

Trusts may have an impact on family law matters depending on case-specific facts. The control of the trust is key in determining its treatment for Net Family Property statements, as well as an individual’s income available for support. For instance, if it is determined an individual has control over the trust, the trust may be reported as an asset on the Net Family Property statement, and the income generated by the trust may, in theory, be available to that individual for support purposes. Other important factors in dealing with trusts, such as history and intent, will be covered in part 2 of this series.

Dealing with Family Trusts may add an extra layer of complexity to Family Law matters. The experts at Davis Martindale can help you, give us a call today for a personalized discussion.

Co-Authors

Louise Poole

CPA, CA, CBV, CFF

Partner

Valuation & Litigation

Janece Boersma

CPA, CBV

Senior Manager

Valuation & Litigation

Work With Us

Our Valuation Advisors are ready to have

a personalized discussion with you.