2021 Personal Tax Filing Information

Preparation

It’s that time of year again! Please read the information below thoroughly and complete our 2021 personal tax checklist to ensure efficient and timely preparation of your tax filings.

Information Required

Please accumulate your 2021 tax information slips, summarize where appropriate and separate for each individual before submitting to us.

We are unable to begin your tax return until we have all of the required documents. Additional details can be found below.

2021 Tax Information and Receipts

- Please complete the 2021 personal tax checklist.

- Sort details for each individual separately.

- Sort your information into categories (donations, business income and expenses, medical expenses).

- Where you have numerous medical receipts, please request an annual statement of your expenses from your pharmacy, dental or other health professionals.

- For electronic submission, group receipts rather than scanning or taking photos individually.

- For all electronic documents, please ensure the image is easily read and includes all relevant elements of the original document. Documents that are hard to read or cropped will delay the commencement of your tax file preparation.

- Visit CRA’s website for details on acceptable electronic files.

- If you own a rental property, or are self-employed, you could tally your expenses or provide a summary – just be sure to keep the original receipts for future CRA review requests.

- Please only include your personal tax return information, do not include your corporate or trust return information.

2022 Tax Facts for Ontario Residents

- We’ve compiled the 2022 tax rates on corporate income, RRSP limits, CPP & EI Limits, prescribed interest rates, automobile amounts, personal tax brackets for salary & dividends, clawback of old age security, pension splitting and other tax credits for your convenience.

- Don’t forget to check out the second page of the document for important tax dates you should remember!

Employees Working From Home in 2021

- Many employees will be eligible to claim a deduction for work space in home expenses if they worked from home more than 50% of the time for at least four consecutive weeks in 2021 due to COVID-19.

- The CRA has introduced two methods in determining the amount of the deduction available, a temporary flat rate method and a detailed method. The flat rate method allows a deduction of $2/day worked from home to a maximum of $500 for 2021, excluding days off including personal or vacation days.

- An additional fee may apply to include this deduction on your return. Please complete the following checklist if you wish to make a home office deduction claim. See Canada Revenue Agency website for a list of deductible expenses.

COVID-19 Benefits

- If you received COVID-19 government benefits including: Canada Emergency Response Benefit (CERB), Canada Emergency Student Benefit (CESB), Canada Emergency Student Benefit (CESB) for eligible students with disabilities or those with children or other dependents, Provincial/Territorial COVID-19 financial assistance payments, Canada Recovery Benefit (CRB), Canada Recovery Sickness Benefit (CRSB) or Canada Recovery Caregiving Benefit (CRCB), these payments are taxable to you and will be reported on a T4A and/or T4E slip.

- Please note that no tax was withheld on CERB or CESB payments and only 10% tax was withheld on CRB, CRSB and CRCB payments. You may owe tax on this income when filing your 2021 tax return.

- On February 9, 2021 the Government of Canada addressed CERB repayments for self-employed individuals and announced interest relief on 2020 income tax debt due to COVID-19 related income support. Find out more

Sending Your Documents To Us

Our offices currently remain open to the public as we continue to monitor the COVID-19 recommendations. However, we continue to encourage our clients to use electronic means for delivering their documents to us and we are committed to providing our valued clients with the high-quality of service you have been accustomed to.

Our Secure Portal

At this time we are strongly encouraging our clients to use the client portal to transfer information to us. It is designed to provide a safe and easy way to exchange information.

- If you are interested in creating a portal account, please email portal@davismartindale.com with your permission and include your name, address and telephone number.

- Free scanning software is available online or in App stores for your smart phone – try these how to videos Adobe Scan, Microsoft 365.

- Genius Scan, Camscanner, Turboscan can easily convert pictures to PDFs that can be emailed or uploaded to our secure portal.

- To sign PDF documents electronically – try these how to videos Adobe Acrobat Reader or iPhone/iPad/iPod touch.

- For electronic submission, group receipts rather than scanning or taking photos individually.

- For all electronic documents, please ensure the image is easily read and includes all relevant elements of the original document. Documents that are hard to read or cropped will delay the commencement of your tax file preparation.

- Visit CRA’s website for details on acceptable electronic files.

We cannot guarantee delivery before the April 30, 2022 deadline if your electronic documents are submitted after April 15, 2022.

We prefer to receive your documents through our secure portal, but you may scan and email your documents to your Davis Martindale contact if you do not wish to use the portal. We encourage you to password protect all documents containing confidential information.

We cannot guarantee delivery before the April 30, 2022 deadline if your electronic documents are submitted after April 15, 2022.

Hard Copy Documents

At this time we are strongly encouraging our clients to use the client portal to transfer information to us. It is designed to provide a safe and easy way to exchange information. If using our secure portal is not an option for you, please ensure all documents are in a sealed envelope before placed in our drop box.

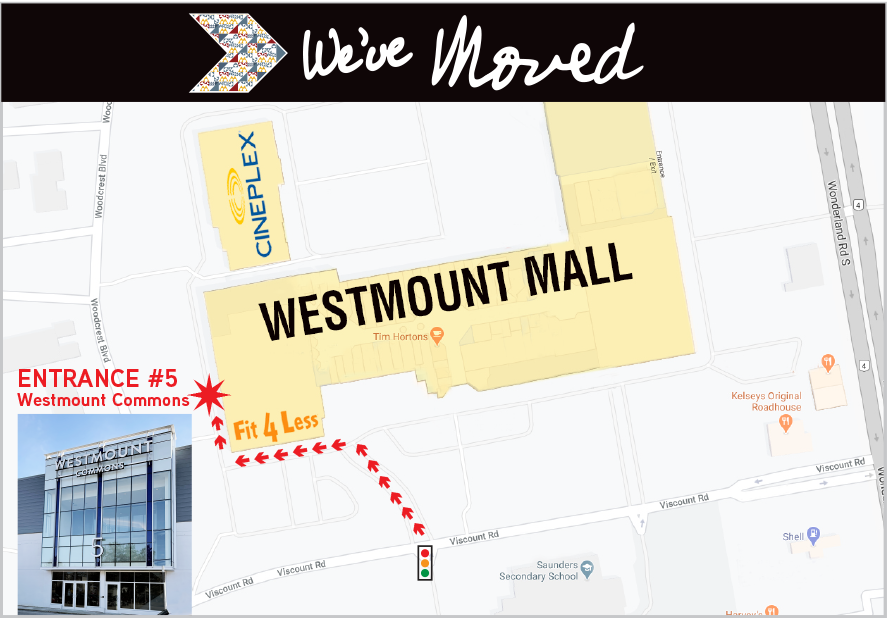

- You will find our secure document drop box just outside our reception door on the 2nd floor at Westmount Commons.

- The drop box is accessible during Westmount Mall opening hours. Please note, Entrance 5 has limited access hours as noted below.

- Westmount Mall Entrance #1, 2, 3 Hours:

- 7am to 9pm Monday to Friday

- 7am to 1pm Saturday

- 12pm to 5pm Sunday

- Westmount Commons – Entrance #5 Hours:

- 7am to 7pm Monday to Friday

- 7am to 1pm Saturday

- Westmount Mall Entrance #1, 2, 3 Hours:

We cannot guarantee delivery before the April 30, 2022 filing deadline if your hard copy documents are received after April 15, 2022.

NEW Location – Drop Box Hours:

- Westmount Commons – Entrance #5 Hours:

- 7am to 7pm Monday to Friday

- 7am to 1pm Saturday

- Westmount Mall Entrance #1, 2, 3 Hours:

- 7am to 9pm Monday to Friday

- 7am to 1pm Saturday

- 12pm to 5pm Sunday

Filing and Payment Deadlines:

Currently there have been no filing extensions for 2021 personal tax filings.

2021 Personal Tax Filing & Payment Deadline

May 2, 2022

Note, it can take CRA at least 30 days to process cheques for tax owed – we recommend paying CRA online.

Self-Employment

Filing Deadline

Individuals with self-employment income must file their return by June 15, 2022.

Tax payment is due by

May 2, 2022.

Deadlines For Submitting

Your Documents To Us

We cannot guarantee delivery of your return before the May 2, 2022 deadline for documents submitted after:

Hard Copy & Electronically

by April 15th

GST/HST Filing & Payment Deadlines

GST/HST returns for self-employed individuals must be filed by June 15, 2022.

GST/HST payments are due by May 2, 2022

Completed Tax Packages

In order to keep our pricing competitive and to lessen the impact on the environment, we are encouraging our clients to make use of our secure portal for delivery of your personal tax package. Through the portal, we can electronically deliver your forms for signature, a copy of the return for your records and our invoice.

- We will be delivering your personal tax package electronically, unless you advise us otherwise.

- If you are interested in creating a portal account, please email portal@davismartindale.com with your permission and include your name, address and telephone number.

- You may still opt for a printed copy of your return should this be more convenient for you.

Mandatory Electronic Filing

We are required to file personal tax returns electronically. After completion of your tax return, we will provide you with a form “T183 – Information Return for Electronic Filing of an Individual’s Income Tax and Benefit Return” which authorizes our office to electronically file your return. You must sign this form and return to us as soon as possible after receiving your package. We cannot file your return until we receive it.

The CRA is now recognizing electronic signatures on form T183.

Other Reminders

Canada Revenue Agency (CRA) Reviews

The CRA routinely requests supporting documentation after your return has been electronically filed. Any requests will be sent directly to us.

- If you have purchased Audit Shield Fee Waiver Service, we will respond to the request and forward a copy of the response to you.

- If you do not have Audit Shield, we will contact you to determine if you would like to respond directly. The minimum fee for this service is $350 and is dependent on the complexity of the information requested from the CRA.

- Please contact us at auditshield@davismartindale.com if you are interested in learning more about Audit Shield, a tax audit insurance policy that protects against additional professional fees in the event you are subject to a post assessment audit, enquiry, investigation or review by the CRA or other Canadian provincial or government revenue agencies.

Reporting the Sale of your House

- After 2015, all dispositions related to the sale of your principal residence must be reported in order to benefit from the principal residence exemption.

- If you sold your home in the year, please provide us with details of the dates of purchase and sale, as well as the original cost and sale price.

- The maximum penalty for a late election on the sale of a principal residence is $8,000.

Tax on Split Income (TOSI)

- For 2018 and later years, there are new rules surrounding distributions from privately held corporations. Unless the payments received fall into one of the specific exemptions, distributions will be taxed at the highest marginal rate. If you think this may affect your tax filing, please bring it to our attention and we will be happy to discuss with you.

Investment Accounts

- Certain tax reporting slips (T3 and T5013) are not required to be issued until March 31st. If you do not anticipate having any of these slips, we request that you send in your information by March 15th to ensure faster delivery of your return, due to volume.

- If you have investment accounts that will issue you T3 or T5013 slips, please send in your information by April 15th. If not received by then, we cannot guarantee delivery by April 30th. .

* CRA has started to assess penalties on unreported income due to missed slips. It is recommended that you contact your investment advisor to ensure that you are in receipt of all reporting slips.

Foreign Reporting

- Foreign Income Verification Statement– If you own foreign property at any time during the year with an aggregate cost of $100,000 or more, you are required to report this property, as well as any income earned during the year from outside the country on form T1135. Vacation properties, or properties held for personal use only, are not caught by these requirements. Failure to file this form when required can result in a penalty of $25 per day up to a maximum of $2,500. The responsibility for ensuring that this form gets filed rests with you. Please let us know if you believe that this requirement applies to you.

- U.S. Filing– If you are a U.S. citizen or are a green card holder you have U.S. filing obligations. If you have spent significant time in the U.S. you may have U.S. filing obligations. There are significant penalties for failure to comply with these requirements. Please let us know immediately if one of the above situations applies to you. There are steps which can be undertaken to become compliant without incurring penalties which may be available to you. These procedures are not available if the IRS “finds” you first.

- Foreign Tax Credits – If you claim a foreign tax credit on your tax return that is NOT reported on a T3 or T5 slip, CRA will request support to verify the deduction. It is imperative we have copies and you retain copies of Notice of Assessments from other countries, proof of payment, refund cheques, slips with income claimed and other important information.

HST Requirements

- Self-employed individuals are required to register for, collect, and remit HST as soon as their taxable sales in any year exceed $30,000. If you have reached this milestone for the first time this year, and have not yet registered for HST, we can assist you with this.

- If you believe that you should have registered in a previous year, please let us know. GST/HST returns for self-employed individuals are required to be filed by June 15, 2021; however, if there is a balance due, the payment must be made by April 30th to avoid late filing penalties and interest.

Questions?

Please do not hesitate to contact our team, we look forward to working with you.